Towards positivity

Weekly 52 2024

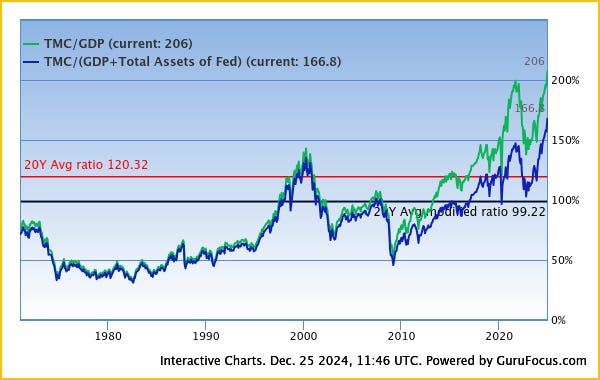

That the U.S. stock market is expensive and exploring uncharted territory is clear to everyone by now. Yet, the narrative persists that the U.S. market can climb much higher and is the only one worth investing in. A world index with a 74% weighting in the U.S. is seen as normal and doesn’t seem to raise any concerns for many.

My opinion on this differs clearly, but I need to stop complaining about it—that’s an early New Year’s resolution.

The question is whether I should continue my monthly updates on the state of the markets. After all, we don’t invest in the markets as a whole, but in individual stocks. On the other hand, I think it’s important to understand where we are in a cycle—if only to emphasize rationality and caution.

So here’s a quick poll:

What’s expensive can always get more expensive, as the Buffett Indicator shows. How long this can continue remains uncertain. Or, as Charlie Munger aptly puts it:

“If you’re not afraid, you’re not paying attention.”

The Buffett Indicator currently stands at 206%, compared to an already high average of 120.3% over the past 20 years. This once again highlights how extraordinary the current situation is.

An interesting fact I recently heard from TJ Terwilliger: the three largest stocks—Nvidia, Apple, and Microsoft—togheter have a market capitalization exceeding $10 trillion. Only these tree companies alone are worth more than any other stock exchange in the world.

Can you believe that just Apple and Nvidia alone are worth more than all the companies on the Chinese stock market combined, which have a total market capitalization of $6.7 trillion?

These kinds of anecdotes might have more impact than the charts and percentages I usually use. Sometimes, a concrete example speaks louder than a thousand numbers.

And yet, CNN's Fear & Greed Index is showing fear.

This actually shows that this measurement is far too short-term focused and is essentially nothing more than a volatility indicator—making it useless for us as long-term investors.

I was asked to find comparable data for Europe, but unfortunately, such information is only easily accessible on a per-country basis. Comparing the 44 European countries to the 50 states of the United States as a whole simply gives a distorted picture.

In Europe, we see inexpensive markets like Spain, the United Kingdom, and Belgium, alongside others that are less affordable, such as the Netherlands, Germany, and Italy. However, just like in the U.S., this paints a skewed image. In the U.S., overvaluation is primarily driven by a select group of companies, as evidenced by the difference between the QQQ (Nasdaq) and the SPY (S&P 500).

A similar pattern emerges in Europe. ASML lifts the Dutch stock market, while in France, the luxury sector dominates. It’s striking that Germany doesn’t appear cheap despite the low valuations of German automakers—SAP seems to have a significant impact on the German index.

Of course, these are considerations at the index level, while we focus on investing in individual companies. Still, we are partly dependent on the overall market climate and, more specifically, on sentiment in the markets where we operate. If Europe as a whole is perceived as "uninvestable," capital flows out of these markets to America. The result? European stocks become cheaper, while American stocks continue to rise in price.

A question I hear more often: will this ever reverse? Will capital ever flow from America to Europe? The chances of that seem slim to me. But is that even necessary? And has it ever been the case?

The answer is: no, it’s not necessary. If European capital stays within Europe, that’s more than sufficient. The bigger challenge is convincing Europeans to invest more in their own region again.

One obstacle is the fragmentation of European markets. While America has just two major exchanges (the NYSE and Nasdaq), European markets are divided among different countries and indices. One or two central European exchanges would be a significant step forward.

Moreover, it’s crucial to stop demonizing or fiscally discouraging investing. In Belgium, this topic is once again on the negotiation table for the forming of a government, and in many other European countries, stock markets lack the attention they deserve as a capital market.

I did something stupid

This week, the following meme appeared on X:

I responded that there’s more to Europe than just regulation. This remark sparked a storm of reactions, with some even resorting to insults. Unfortunately, the internet, much like driving, isn’t always a place that brings out the best in people.

Are there problems in Europe? Absolutely—just as in any region of the world. But are these problems insurmountable? I don’t believe so.

The meme I referred to focused mainly on our regulations, and many of the responses pointed to our politicians. It’s important to remember that politicians are here to work for us, not the other way around. Change starts with us: we need to be clearer about what we won’t accept and demand change. Right now, this power is often used primarily by minorities. It’s time for the majority to speak up again.

I want to do my part to counter the negative sentiment surrounding Europe. That’s why, as often as possible, I will highlight a great European company in the Tuesday newsletter (available to all readers). These won’t be in-depth analyses like our main selections but will serve as a way to show that Europe remains a hub of innovation, hard-working people, and outstanding companies.

With this initiative, I aim to focus on positivity. Feel free to share this message and refer people to Valuing Dutchman so that, together, we can show that Europe still has plenty to offer.

Which ETF’s would I buy

Last week, I received an interesting question from a reader that gave me pause for thought. Often, I’m asked why someone would still invest in individual (European) stocks when ETFs allow you to achieve decent returns from the comfort of a hammock. This reader, however, also wanted to know which ETFs I would choose if I were to invest in them.

After much consideration, my answer today is: none.

ETFs guarantee an average market performance. While this has often resulted in solid returns in recent years, there will inevitably be periods when that average feels far less appealing. Moreover, I see a worrying overconcentration in U.S. stocks, particularly in big tech. It’s unhealthy that companies like Apple, Nvidia, and Microsoft are each worth more than some national stock markets (for example, the Chinese market, with less than $7 trillion, compared to big tech firms exceeding $10 trillion).

Additionally, a significant portion of U.S. growth has been fueled by debt. When comparing the U.S. debt ratio (123.1% of GDP) with Europe, the U.S. trails only Greece (163.6%) and Italy (137%), but still surpasses France (112.2%) and Belgium (108%). For comparison, the debt-to-GDP ratio for the entire EU is 88.1%. This gap has widened particularly in recent years.

All this makes me wary of excessive exposure to the U.S., especially to overvalued growth stocks. As a result, world ETFs or S&P500 ETFs are off the table for me.

An ETF focused on small caps or value stocks isn’t appealing either. These are selected based on quantitative factors without accounting for qualitative aspects, resulting in a lot of “junk” in the selection. Small caps and value—or a combination of the two—would never work for me in ETF form.

Europe has its own challenges. Due to fragmentation in European markets, a European ETF often overexposes you to former winners or companies that are too small. Country-specific ETFs don’t provide a better solution due to their limited selection. For small caps, value, and Europe, I see opportunities primarily for stock pickers.

Emerging markets ETFs could be a possible addition, but I don’t invest in individual companies in these regions because I can’t fully understand them. So why would I want to buy the entire market?

Furthermore, there are plenty of excellent holdings to cover regions or sectors, such as Berkshire, Markel, and Fairfax in the U.S., as well as our own selection, which provides exposure to both the U.S. and India.

In short, I wouldn’t buy any ETFs at the moment. If the market situation changes, I might recommend saving in a world index for those who consciously opt for an average result. But for my own portfolio, I’ll continue to focus on a thoughtful selection of holdings. That’s as passive as I’m willing to get.

Articles and updates this week

Last week, we received figures from Hornbach; otherwise, it already felt like Christmas had arrived.

Read the Hornbach update: Is the 10% drop justified?

No article was published on Tuesday due to the holiday season.

Best wishes

Wishing everyone all the best for the new year, from my family to yours.