Take advantage of Mr. Market

Weekly 46 2024

It seems crystal clear where the opportunities lie to make money on the stock market in the future, yet almost no one does it.

Benjamin Graham, the father of value investing, introduced "Mr. Market" as a fictional character to teach investors how to deal with the stock market’s ups and downs.

Imagine Mr. Market as your manic-depressive business partner, showing up at your door daily with an offer to buy your shares or a price at which he’s willing to sell his own. His shifting emotions determine that price, as Mr. Market is, after all, manic-depressive.

Most of the time, when his medication is working, he’ll make offers that are best ignored. The good thing is, he won’t get offended if you ignore him for a while—he’ll be back tomorrow with a new offer.

But sometimes, his emotions take over. In times of euphoria, he’ll make you an offer that’s hard to refuse, and that might be a good time to sell (some of) your shares. On other days, he offers a price so low that you’ll want to buy as many of his shares as you can.

The lesson is simple: don’t be swayed by Mr. Market, but do take advantage of him.

When Will the Bubble Burst?

Today, it’s clear: Mr. Market is in a manic mood. Everyone senses that this market is no longer behaving normally. The question isn’t if a correction or crash will come, but when. You can feel the moment approaching.

The election of Trump seemed to be enough to push Mr. Market back into full mania. Cryptos are skyrocketing, and many stocks are following suit.

A manic period also brings excesses, often in the form of new products—now taking shape as ETFs, which have become incredibly popular. There are ETFs that not only track indexes but also sell options to pay out monthly or weekly income. This is happening even with individual stocks like Nvidia, and now a major player wants to apply this to Berkshire Hathaway. A leveraged ETF with derivatives wrapped around it—what could go wrong?

You’d think we’d learned from 2008, but no, greed is stronger. Instead of using the stock market for its intended purpose—a place where companies can raise capital to grow and help move society forward—complex products are being created that will likely collapse in the end.

Then there’s the AI frenzy, and everything points to a market that’s completely manic.

Small businesses are entirely overshadowed

Meanwhile, small businesses are entirely overshadowed. No one pays attention to them anymore.

On X (Twitter), I came across some interesting posts from @mavix_leon. He shared a few charts from a recent letter by Verus Capital, which I’d like to share with you.

Small caps are currently about 42% undervalued compared to large caps. Historically, periods of small-cap undervaluation (like between 2006-2009) alternate with phases of overvaluation (such as in 2001-2003 and 2011-2013).

The current undervaluation of small caps is comparable to that seen in 2006 and 2009, and is even greater than during the dot-com bubble.

The most common response to this is: “Yes, but look at how those big companies are growing.” That’s true for the few major companies currently in the spotlight, but it doesn’t hold for the broader market. In fact, S&P 500 earnings have barely grown in recent years.

On the other hand, small caps are expected to see higher earnings growth than the big companies.

So, we’re in a situation where small caps are expected to have higher earnings growth while being undervalued. Isn’t that exactly what an investor looks for?

And then, of course, there’s the issue of Europe. European companies are performing much worse than their American counterparts.

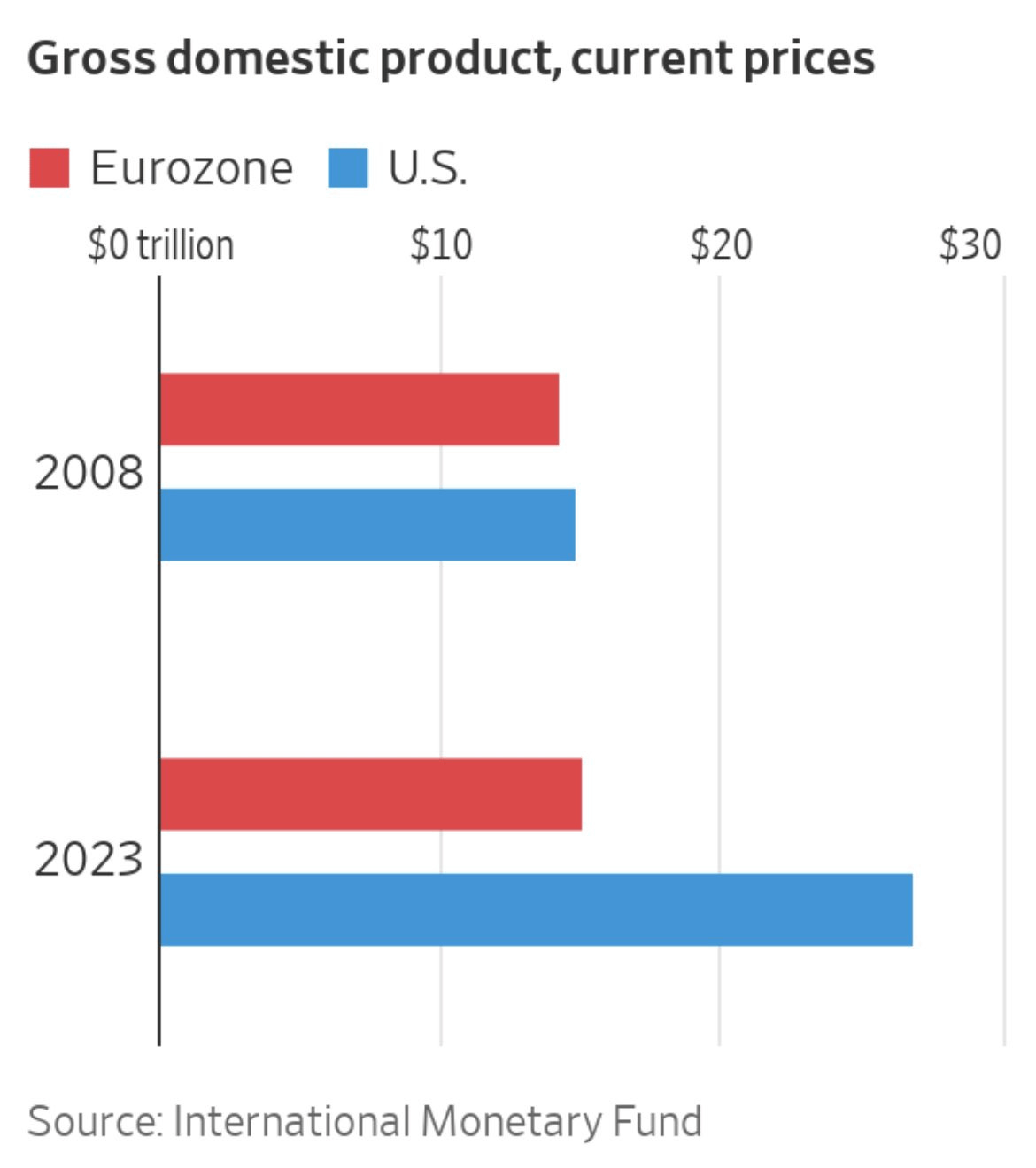

Consider economic growth as well: in 2008, the U.S. and European economies were roughly the same size. Today, the U.S. economy is more than 50% larger.

The European economy has barely grown over these 15 years. Here, we see the consequences of excessive political interference.

Europe chose regulation, afraid of losing what it already had, while the United States opted for innovation.

The following image, from Marek Matuszweski, captures this perfectly.

Not to mention the anti-business rhetoric in Europe.

You could say that what the EU has too much of, the U.S. lacks—and often the other way around. Under Trump, that’s unlikely to change in the U.S., but hopefully, Europe will see a shift.

These policy differences have led to European companies underperforming compared to American companies, creating a historically large valuation gap. European markets are now valued 40% lower than U.S. markets, where historically this was around 20%.

In other words, for the same euro or dollar of profit, investors now pay 40% less, whereas typically it was only about 20% less.

Companies in Europe that have not only survived but also made progress over the past fifteen years are strong enterprises. Imagine what could happen if the mindset here shifts, and people realize that the balance has tipped too far—something you can already start to sense.

With the current, historically low valuations of small caps and European companies, combined with a potentially changing political climate, it’s becoming increasingly clear where future opportunities lie for making money on the stock market.

This starting point is particularly attractive for investors in European small caps.

Articles and updates this week

This past week, we received the quarterly results from Kamux, Cake Box, and F.I.L.A. The results from K+S, published this morning, will be in your inbox tomorrow.

Read the Kamux update: Sweden Continues to Weigh on Results

Read the Cake Box update: Will there be another bid?

Read the F.I.L.A. update: Investment in Doms, the Rest is Free

This past Tuesday, the 3P Check for Meta was published, in which I examined whether the current price being paid for Meta (Facebook) is still justified.