Cake Box

Example report

After the example report of Smartphoto, I also present the analysis of Cake Box for everyone to read. The reason for this is that I have discussed this company several times on social media and in Mr. Market Magazine's Longest Stock Market Competition.

Cake Box and Smartphoto are two companies that also embody what I prefer to look for, namely companies with a strategic shareholder, where there is sufficient growth potential, but the market does not fully appreciate it due to temporary problems or additional expenses. In the case of Smartphoto, the investment in the new factory was a factor; for Cake Box, there is the debacle with incorrect figures in the annual report and the investments in additional controls and the subsequent management changes.

In my opinion, both of them are perfectly positioned at the intersection of quality and value. However, I hesitated to choose these two for a moment. Firstly, at first glance, based on the price-to-earnings ratio (P/E ratio), they are not cheap with P/E ratios of 15.6 and 20.6, respectively. This may create a somewhat one-sided view and focus too much on growth, while I classify myself as a value investor and also have companies with a P/E ratio of 3.

Secondly, both are very small companies. I prefer to focus on small and mid-caps, but even Cake Box and Smartphoto fall under that category, known as microcaps. Cake Box is the smallest company in my portfolio. I do not want to give the impression that all the companies I look for or include in the selection are this small. The range goes from Cake Box as the smallest with a market capitalization of €80 million ($88 million) to the largest at €63 billion ($66 billion). However, most of the companies fall between €200 million and €3.5 billion. This shows that I am not fixed on a particular segment but do have a preference.

With the above in mind, I would like to introduce you to Cake Box.

Cake Box

Description

The charm of small companies like Cake Box Holdings is their simplicity. Cake Box is a franchise of pastry shops, specifically specializing in egg-free pastries. An egg-free diet may be adopted for health reasons or due to religious beliefs. It was unfamiliar to me before I analyzed Cake Box, but apparently, a certain part within the Hindu community is not allowed to consume eggs.

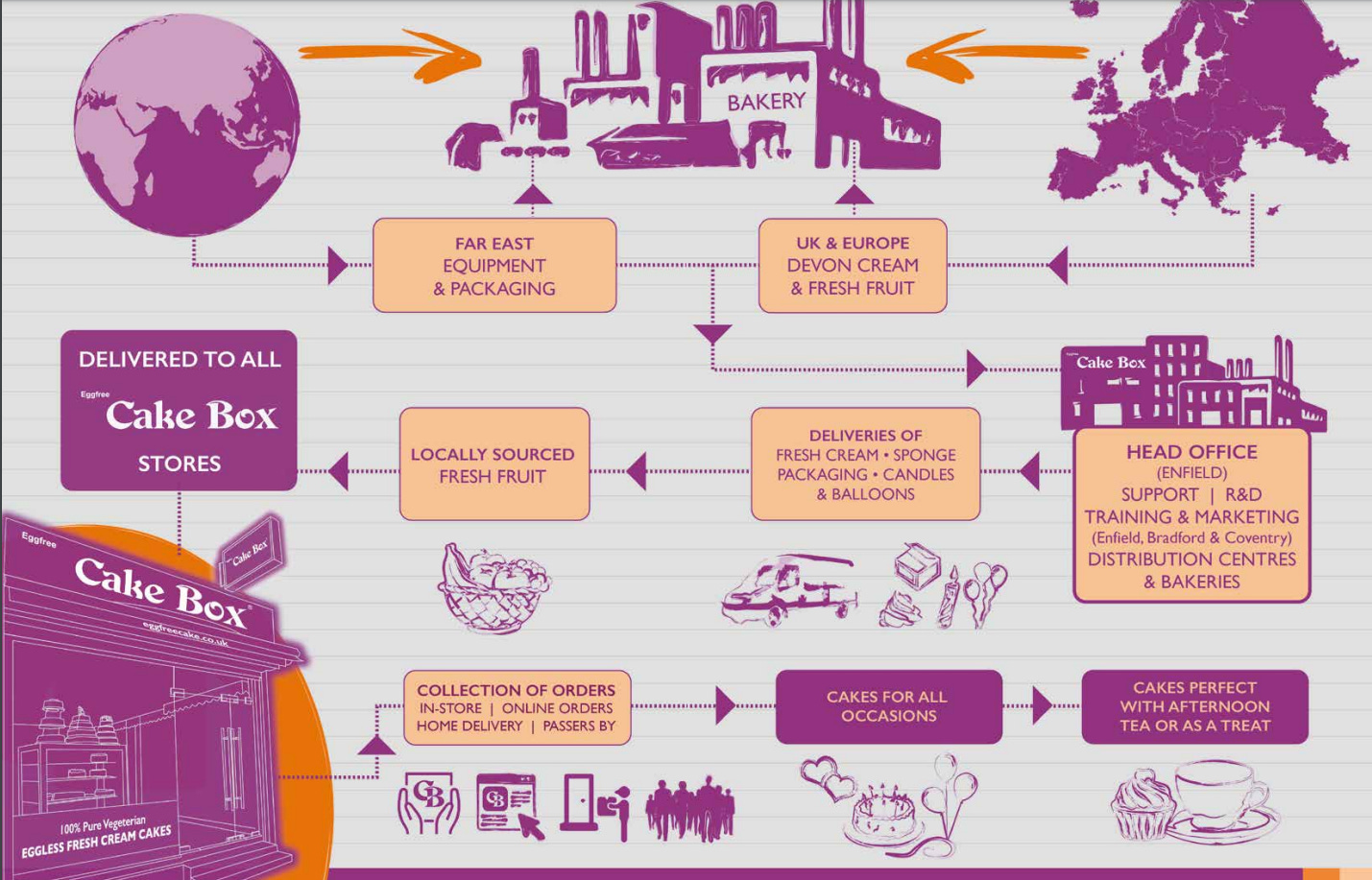

This image from the 2020 annual report encapsulates the entire company:

At Cake Box, you'll find cakes and pastries for all sorts of occasions, such as birthdays, and weddings, with or without photos...

Cake Box has grown from 1 store in London in 2008 to 133 when we first examined the company in March 2020, and to 215 today. That is to say, the founders of this franchise group originally started with a single store, but today Cake Box no longer owns any of its stores; they are all operated by franchisees.

In addition to the stores, some franchisees also operate kiosks in busy shopping centers. This is less focused on selling cakes and pastries for events but more on immediate indulgence. Kiosks can also be found in a few Asda supermarkets; this is still in the testing phase.

At the close of the half-year ending in September, the store count stood at 214. These are operated by 165 franchisees, meaning that 46 franchisees own multiple stores. Additionally, there are 44 deposits for new stores, with 20 of them being placed by existing franchisees.

The success of a franchise model is entirely dependent on the franchisees. Not only the quality, which Cake Box ensures through its training and support, but also their satisfaction and earnings.

The training that franchisees undergo is intensive, lasting for 4 weeks, after which they can start, of course, with ongoing guidance. This makes the concept very attractive to individuals looking to start something on their own.

A friend who is a fund manager, specializing in retail, conducted a quick comparison for us. This positions Cake Box in the top 3 in the UK as an interesting concept for franchisees. Note, that this is based on only 20 data points, but we can assume it is certainly above average.

Franchisee satisfaction appears to be high. They do not see each other as competitors but as one big family. During the COVID-19 pandemic, they helped each other in case there were issues to stay open or if there were shortages of raw materials.

Cake Box itself has also played its part in recent years. As inflation increased, they absorbed a significant portion of the rise in raw material and logistics costs. They did this not only to avoid a sharp increase in prices for end customers but also to ensure that franchisees continued to make a profit.

In addition to these measures due to inflation, the opening of a third bakery and warehouse location also impacted cash flow. With these three locations, they cover the entire United Kingdom: Bradford for the north, Coventry for the central region, and Wales and Enfield for the south and Scotland.

In total, their target in the United Kingdom is around 400 stores, which translates to another 3 to 5 years of growth in the number of stores. Additionally, it takes about 2 to 3 years for a store to reach its full potential. This gives us a reasonably good picture of the growth for the next five years.

Of course, they have by now outgrown the niche of specific communities. The egg-free cakes have gained popularity among the general public; and among vegans, their cakes are well-liked. It's also very convenient that for a wedding or birthday, you don't need different cakes for those who are vegan or not – you can just have one large cake. This opens the door for potential expansion into other countries, but let's hope they don't rush into that too quickly; the quality of the cakes may not be sufficient for the palates of, for example, the Belgians.

To appeal to a broader audience, they are adjusting their identity and giving themselves a different look. The bright purple hue as it is now:

They would transition to a softer, more elegant image. This was presented as a concept.

II understand that this is a necessary step, especially if they want to cater more to the vegetarian and vegan communities, but it always remains a risky move. They must not go too far with it, so as not to lose their existing customer base.

They are also working on brand awareness. Alongside franchisees, a £2 million campaign has been launched with advertising on national radio, social media, and other digital channels.

The new website, launched in June, is already yielding encouraging results.

Marketposition

A direct comparison with competitors is challenging for Cake Box. The names I came across that form direct competition, such as The Little Cake Cottage, The Cake Shop, Cakes By Robin, and Heaven is a Cupcake, are not publicly traded. These are all individual stores and not part of a chain or franchise network. These also seem to offer more upscale products, at least that's the impression I gathered from my online research.

Eggless Cake Shop seems to be a copycat at work, primarily around Birmingham, with around 25 stores. Even the colors, which I am not a fan of, were copied.

From what I could find online, including advertisements to attract franchisees, these stores seem to have lower turnover per unit than Cake Box stores. They mention a turnover between £200,000 and £250,000, while Cake Box stores average around £350,000. Moreover, Cake Box can spread the costs across many more locations, and it will be expensive for Eggless Cake Shop to start another bakery at a different location.

It would concern me more if no initiatives were copying the egg-free concept. The fact that this initiative has managed to grow to around 25 stores is additional evidence of the concept's success and could potentially make them acquisition candidates for Cake Box.

In the comparison below, I have chosen a few other food retailers that also engage in franchising, although these also have their own stores. Additionally, they represent entirely different concepts. For example, Gregg's is a ready-to-go bakery with products and beverages, SSP Group also offers convenience food in train stations and similar locations. Domino's Pizza probably speaks for itself. The only thing we can learn from this is that the margins and return figures are favorable in comparison, and they are more conservatively financed.

Who

Sukh Ram Chamdal is the founder of the first Cake Box store and the current CEO of the Cake Box franchise, which he co-founded a year later with Pardip Kumar Dass.

Chamdal owns 25.4% of the shares. Near the peak of the market in 2021, he sold a significant amount of shares to diversify his wealth. While not unusual, it was a signal that the stock had risen too sharply in a short period. In 2022 after the stock halved from it’s peak he bought some additional shares.

Chamdal has been active in the food and retail industry for 35 years, starting with the sale of Indian sweets. Before that, he worked as a caterer for events with vegetarian food. In short, he is well-known in the industry.

Pardip Kumar Dass owned 9.74% of the shares, but after errors emerged in the annual report (note: not in the accounting, only in the reporting), and the auditor resigned due to inadequate monitoring systems, the then-CFO and co-founder was sidelined, and Cake Box rapidly professionalized. Frankly, this should have happened before the IPO.

It was evident from the mistakes made that there was no fraud or other unethical activities; these were errors of a CFO overwhelmed by the company's growth. He was also going through a divorce during this period, which may have contributed to his lapse in attention.

In this divorce, his ex-wife acquired half of his shares. Dass sold his shares, presumably because he needed the money and perhaps out of dissatisfaction. His wife retained the majority of her 3.77% stake acquired during the divorce and is the second-largest individual shareholder with a 3.3% stake.

Jaswir Singh is the Commercial Director, formerly COO, a role now filled by Richard Zivkovic. Although he is a trained doctor, he started working in the family business in textiles in the 1990s. From 2000 until he joined Cake Box, he operated his restaurant. He bought shares after the blog post exposing Dass's errors came out, purchasing around GBp277. He now owns 1.44% of Cake Box.

Singh is also a co-owner of 6 Cake Box stores, creating a short line between the stores and the franchise group, and innovations are often tested in these stores first.

After a blog post about Dass's errors and the subsequent stock decline, the organization was strengthened. Richard Zivkovic became COO and was tasked with improving structures and IT. He comes from Island Poke, a grab-and-go food retailer, also in the form of a franchise.

Finally, Michael Botha joined the team as the new CFO in April 2023. Botha has held various roles, both commercial and financial, in several franchise concepts, including most recently the largest franchise group for Domino’s in the United Kingdom and Ireland.

Some numbers

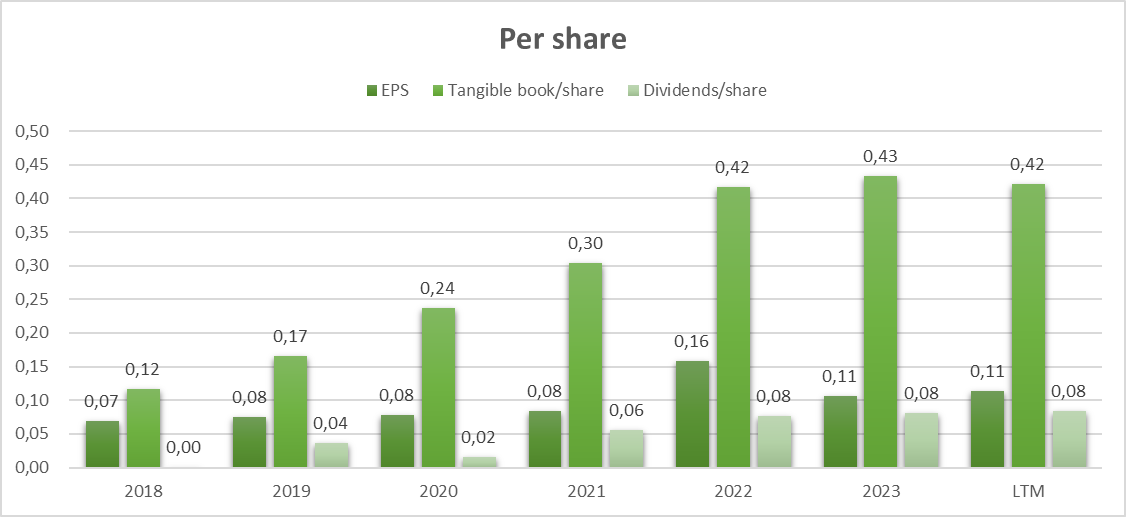

Cake Box has been listed on the stock exchange only since 2018, which means we do not have a ten-year overview, and for per-share figures, we can only look back on five years.

During this period, we had to navigate through the challenges of the COVID-19 pandemic, during which everything was shut down in England for a certain period. Remarkably, even during these years, there was still revenue growth. In 2022, we see a significant jump where the missed growth from the past was suddenly caught up.

The rising gross margin is primarily a result of more efficient operations due to the increased scale. The dip in 2022 can be attributed to higher costs of raw materials and transportation.

We see that the operating and net margins were somewhat under pressure because they did not pass on all the increased costs to their franchisees, and there were investments for the third location of bakeries and warehouses. Add to that the investments in strengthening operational and control processes, hiring the new CFO, and fortifying management, and I conclude that the operating margin of 25% from 2018 is unlikely to be quickly regained, if ever.

We also observe that despite the nicely rising gross profit, the profit for the fiscal year 2023, which ended in March, was somewhat under pressure. This was, of course, the period with the highest inflation and high energy costs. Improvement is evident in the current fiscal year.

We observe a similar trend per share, as no shares were added or destroyed. The dividend was kept stable, causing the payout ratio to rise to just under 73%. Despite this substantial payout, the net cash position continued to grow. At the end of September, it amounted to £5.9 million, or £0.1475 per share, approximately 8.5% of the market price.

Looking at the growth figures and returns, one cannot help but conclude that they are quite impressive. Returns on equity and invested capital of more than 20%, with an average net margin of 12.6%, including the challenging year of 2022 – what more could one ask for?

The question, of course, is how sustainable these figures are in the long term. Is egg-free cake a temporary phenomenon? Or will they be able to further appeal to the vegan community, potentially unlocking even more upside potential?

Cake Box is also a capital-light company. Apart from the bakeries and warehouses, the costs for the stores are borne by the franchisees. The debt component mainly relates to the leasing of the warehouse in Enfield; the other two locations are owned.

Risks

The biggest risk is that Cake Box management might want to expand too quickly. Expansions in the UK are relatively easy to achieve, but if they wish to continue growing and go international, this will involve high startup costs. The formula will need to catch on fairly quickly.

I also wonder whether the quality of the cakes, for example, would appeal to customers in the Netherlands, Belgium, Germany, and France. So far, this doesn't seem to be a priority, but it is indeed one of my concerns.

Another risk with a food franchise is quality control. A few bad stores can, especially in these online times, damage your reputation. Most individual Cake Box stores receive a multitude of excellent reviews. Negative reviews are often attributed to the kiosks in Asda supermarkets. Something to keep an eye on. The reason for this was that the products in the kiosks were not discarded quickly enough if they were not sold. This seems to have improved now.

Furthermore, we can also assume that it will take some time for the market to forget the reporting errors of the previous CFO. There is always a concern of fraud lingering. The company will first need to prove that all the new adjustments are effective.

Especially IT and customer service must be able to keep up with the growth.

Conclusion & valuation

Regardless of the economic situation, there will always be birthdays, weddings, and other events, big or small, that we want to celebrate. And that inevitably includes cakes.

The competition is either small and local or a large industrial chain and therefore not as flexible and fresh. In addition, their egg-free concept is relatively unique.

As a franchise group, they are not as capital-intensive as they would be if they had to operate everything themselves. Additionally, franchisees are often much more active and entrepreneurial than regular employees, which will certainly aid growth at the store level.

Cake Box is a small company that can continue to grow at a good pace for several more years. Major expenses for the third location, the professionalization of IT, monitoring, and management are now behind us. All of these weighed on cash flow in recent years, although it remained very attractive. After these growing pains, they have now entered the next phase of their maturity.

Because the cash flow was negatively impacted by the above factors, a standard discounted cash flow valuation, in my opinion, would yield too low a value. You would then need to start from a 'normalized cash flow.' This, along with the estimates you have to make for growth, will result in this calculation swinging in various directions with relatively small changes in estimates.

Let's keep it simpler. We know that they aim for four hundred stores in England and that once mature, the stores, on average, generate around £360,000 to £375,000 in revenue. This translates to revenue for franchisees of £144 million to £150 million. Historically, about 46% of this revenue flowed through to Cake Box. The fees paid by franchisees for new stores are then eliminated. This results in revenue for Cake Box in its mature phase in England of £66 million to £69 million, a small doubling compared to the fiscal year 2023.

In the last fiscal year, a net margin of 12.6% was achieved, despite the additional costs for strengthening IT, control systems, and management, and during a period in which they sacrificed margin to support their franchisees. I assume that in the complete mature phase, we return to the average of around 18%.

If we calculate further, in the final phase within about five years, we can expect a profit of £11.88 million to £12.42 million, rounding to £12 million. Assuming they don't buy back their own shares during this period, although it could easily be done with the free cash flow, that would be an earnings per share of £0.3.

For a company that is no longer growing, I am willing to pay 8.5 to a maximum of 10 times earnings, which would amount to a price of £2.55 to £3 per share. In addition, we can then add the current cash position of £6.3 million (£0.1575 per share) + what they don't pay out as dividends from the profit over the next five years, which I estimate to be around £0.91 (30% of the increasing net earnings per share each year), resulting in a realistic price range of £3.62 to £4.07. Since I did not apply any discounting of currency, I round it off to £3.50 per share.

The dividend yield, currently at 4.83%, helps us wait during this time.

If I use more traditional methods like discounted cash flow, the Graham or Greenwald EPV formula, assuming a normalized profit or free cash flow, I arrive at prices between £2.25 and £6 per share. As I mentioned earlier, there are many estimates to be made, hence this wide range. But a minimum of £2.25 seems reasonable. This still provides almost a 30% margin of safety at the current price. With £3.50 as the fair value via the simple valuation reasoning I made above, I don't think I am being overly optimistic.