Smartphoto

Example report

Below you can find the report of Smartphoto a Belgian business specialized in personal gift items.

Smartphoto has been in the selection of Smart Capital (Dutch newsletter) for longer.

This report serves as an example of what paid subscribers can expect.

Smartphoto

Description

The Belgian company Smartphoto produces and sells personalized products, including photo books, cards, calendars, wall decorations, puzzles, bowls, mugs, smartphone covers, placemats, but is also still active in printing photos.

And there lies the origin of Smartphoto, the printing of photos, among others for professional photographers, which they still do under the old name Spector. Time for a bit of history.

For those who didn't know, I also have a background in the photo trade. My father started his photo shop in the late '70s, including the rapid self-printing of photos. What now seems evident was far from it at that time. Later, my sister and I joined the business, which, in addition to photos, was also active in telecom, and we expanded it into IT and various electronics. Consequently, Spector was certainly not unknown to us.

In the photo trade, there was a massive disruption before the term was even used. First, there was the digital camera, which multiplied the number of photos taken by x100, but the number of prints dwindled. When the mobile phone, or then already called a smartphone, got a camera with decent quality, all hell broke loose. The producers of photo paper, Agfa and Kodak, piled up losses, and even Fuji threw in the towel and shifted its focus elsewhere.

The large photo labs with very expensive machines were pushed out of the market by digitalization, with online players like Foto.com competing with smaller, much cheaper machines, and there wasn't a significant difference in quality.

And so, the then Spector found itself on the brink of collapse with an expensive and outdated machinery.

Yet, I believed in Spector Group, today Smartphoto. I saw that their old divisions, including the retail chain Photo Hall, which went bankrupt in 2012, and the wholesale Filmobel, which was discontinued in 2014, had no future. However, for me, it was about what was then called Extra-Film, the web and mail-order company that was already operating in 13 countries.

In 2011, when I had just started writing a financial newsletter, I wrote this:

I would like to delve a bit deeper into the products. In the past, when everyone still used film rolls, people were always curious about their photos. After all, they hadn't seen them on their camera or PC yet. Moreover, all photos on the film roll were printed, regardless of whether they were good or not.

Although digital cameras now capture many more photos than before, as it costs nothing after acquiring the device (besides, every mobile phone also has a camera), only a fraction of the number of photos are developed compared to the analogue era. The reason for this is that people have already seen the photos and can also review them on their PC, digital frame, iPod, TV, and so on. How many people have thousands of photos on their PC that they will never print, or forget to print after a while? How many grandmothers complain that they no longer have photos of their grandchildren?

And that is the difference between the analogue and digital eras in photography. In the past, a photo served as a memory, the capture of an event. Regardless of whether the photo was of good quality or not, it was an emotional product. In the digital era, a photo no longer needs to be printed to have the same emotional value.

The role of the photo has shifted from being a memory to becoming a gift item. Photos are no longer printed to be stored in a drawer. A photo is printed to be framed, to be given as a gift to grandmothers, up to full photobooks and so on.

Slowly but surely, the industry has understood this, and the focus has shifted from traditional photos to gadgets, such as photo puzzles, placemats, calendars, car sunshades, t-shirts, cushions, teddy bears, and more. The range of products is constantly expanding. The advantage of gift items is that people are willing to spend money on them.

The ability to easily create cards and invitations with a photo online is also experiencing strong growth, as well as photobooks that replace traditional albums. In short, it's the ancillary products of the past that will replace photos as the core business. ExtraFilm has struck a nice deal with Studio 100 for these products. They have the exclusive right to produce and finish certain gadgets, such as calendars featuring photos and characters from Studio 100, including Maya (the bee).

Meanwhile, even grandmothers are taking digital photos and actively participating in social media, so they no longer feel the absence of the old photos.

In short, I had seen the future for Smartphoto, but in 2011 I was still too early; they were still carrying the entire legacy. In 2014, I bid farewell with disappointment, experiencing a loss of 27%.

But this turned out to be the wrong move—not immediately after, but when considering the entire period. Adjusted for the split, I bought Spector, now Smartphoto, at €6.6 per share.

If I had held onto Smartphoto, I would have experienced an annual compounded return of 12.2%. My assessment of the company was correct; I was simply too early. In other words, being right is not always enough; timing and emotions also come into play.

A lengthy story to emphasize my strong belief in a company that produces quality, affordable personalized gift items. A mug with a photo is simply delightful to use every day for your coffee or tea. It wears out over time, providing the giver with the opportunity to renew (hooray, no need to search for a gift idea again). It goes without saying that the added value is much greater than with ordinary photos.

Of course, it's crucial that Smartphoto continues to innovate in products, as they did opportunistically with personalized face masks. But even more importantly, they excel at making the creation and ordering of these products very easy for the consumer. This ease of use is a key factor in their success.

They also go the extra mile in customer service. If a customer makes a typo in the product, they receive a free reprint, which they call the Smart guarantee.

For instance, if communion cards are printed, and unexpectedly the celebration cannot take place on the specified date (as during Corona), they offer a free reprint.

Finally, quick delivery is also essential. They deliver your product throughout Europe just a few days after placing your order, with an increasing number of products available for next-day delivery. This is particularly important for those who tend to be last-minute with Christmas and birthday preparations.

Smartphoto operates in twelve countries but can deliver its products throughout Europe. Each product is typically produced and shipped within an average of 2 days, ensuring delivery within a few days. During the year-end holiday season, this volume can peak at 40,000 packages per day.

In late 2021, Smartphoto acquired Nayan, a Belgian company and one of the European leaders in e-commerce-as-a-service for international brands. Nayan specializes in selling personalized gift packages containing chocolates, beverages, fruit, or flowers through the websites Gift.be and GiftsforEurope.com. E-commerce-as-a-service includes digital marketing, sales, and customer service for consumer brands such as Godia, Samsonite, Kitchen Aid, Neuhaus, JBC, Leonidas, and others.

Primarily engaged in business-to-business activities, this acquisition complements Smartphoto's direct-to-consumer focus. The shared expertise brings both companies to a higher level as a combined entity.

Moreover, the addition of Nayan makes Smartphoto somewhat less dependent on the year-end peak, although this period still holds significant weight.

Nayan contributed approximately 20% to the total revenue last year.

Marketposition

Smartphoto is also highly attractive because the competition has significantly decreased, placing them in a kind of oligopoly with the German company CEWE. With some good will, we can also include the French company Calaranova, although it has more significant operations in other sectors. Of course, there are always other players in specific products, such as Albelli. Unfortunately, Albelli is not publicly traded, so there is limited information available about them.

The German company CEWE is many times larger than Smartphoto, with a turnover that is almost 10 times greater; in 2019, this difference was nearly 14 times.

In terms of profit margins, Smartphoto and CEWE are relatively comparable. However, Smartphoto has managed to operate more efficiently in recent years, resulting in a higher percentage remaining on the bottom line.

The return ratios are somewhat lower. I would like to say that this is because Smartphoto is very conservatively financed compared to CEWE, but CEWE also has a very low debt ratio. Part of the explanation is that Smartphoto has recently made significant investments in a new factory, leading to additional costs and staff expansion.

The main difference lies in the growth. Over the past three years, Smartphoto's revenue has grown by 13.2% per year, whereas CEWE's growth was 2.3%. Net profit and earnings per share present a distorted picture. Smartphoto generated an exceptional profit during the pandemic, while CEWE reported a lower profit. Looking at the last five years, we see a growth in earnings per share of 7.7% for Smartphoto and 6.1% for CEWE.

I expect this difference to increase now that the costs of the acquisition of Nayan and the expansions resulting from the new factory are diminishing.

Smartphoto is the market leader in Belgium and Sweden and holds the number 2 position in Switzerland. They acknowledge that they are not yet present enough in Germany and France, two larger countries. Hence, there are still opportunities for growth in these markets.

Who

Three major shareholders collectively own 66.8% of Smartphoto.

Philippe Vlerick serves as the chairman of the board and is a director in many other companies, including KBC, Exmar, Besix, Mediahuis, among others. He holds approximately 20.04% of Smartphoto through various companies.

Shopinvest owns 18.29%. Shopinvest is the investment company of the founding family of E5 mode, which they sold a few years ago. Hans van Rijckeghem represents them on the board of directors.

The third major shareholder is Marc Coucke, a wealthy Belgian entrepreneur, who owns 15.98%.

An additional 8.9% of the shares are held by the company itself. Partfim, owned by Emmanuel Rolin Jaequemyns (formerly of bank Degroof), holds 3.59%.

There are indeed multiple intelligent shareholders with a sufficiently significant stake to help steer the ship.

The captain is CEO Stef De Corte, who has held this position since 2012 but has been active in the group since 1999, witnessing the entire transformation and leading the majority of it. He owns 0.15% of the shares.

Numbers

As mentioned earlier, Smartphoto is conservatively financed, with more cash than debts. This is partly attributed to the nature of Smartphoto's business. They receive payment from customers immediately upon order, while they pay their suppliers on a longer-term basis. Consequently, they have very little to no need for working capital.

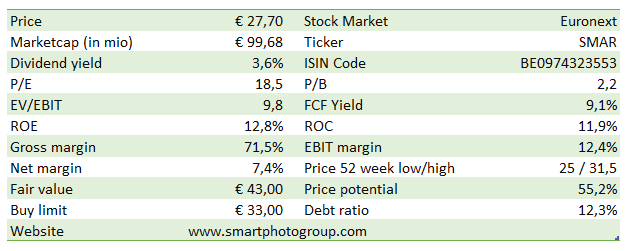

With a debt ratio of 12.3% and prompt payments from a large customer base, there is no need to be concerned about the stability of the company.

We also see a company that is steadily growing without significant cyclical fluctuations.

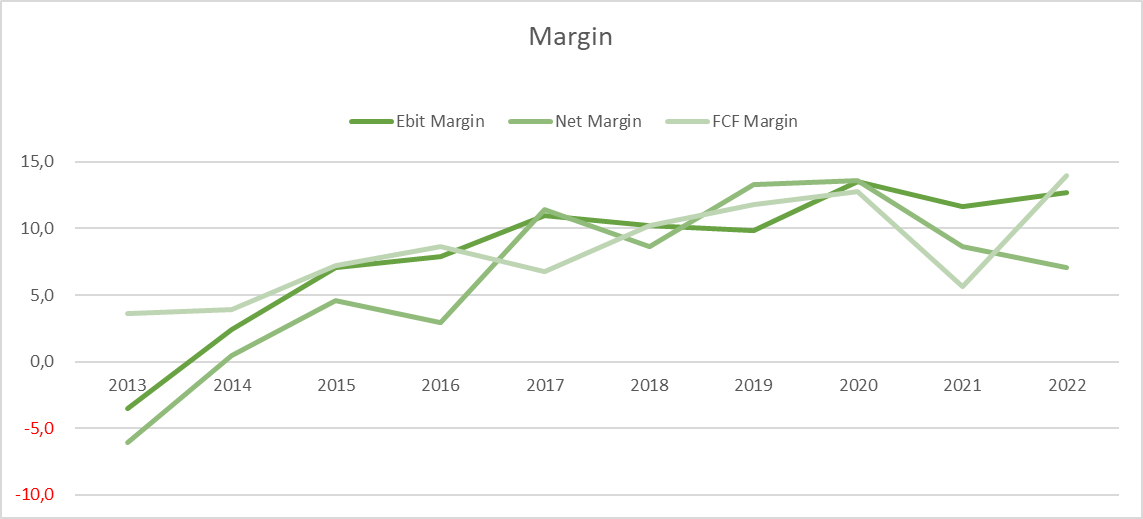

This is happening while the profit margins are gradually improving, although, of course, it's not a straight-line progression.

Over three, five, and ten years, we observe a positive trend in both revenue and profit growth.

Over the ten-year period, you'll notice that while revenue growth is lower then over the past 5 years, the profit increases a lot. This is primarily due to the divestment of less profitable divisions. As a result, we see an average growth of 85.6% per year for profit over the ten-year period, but it's crucial not to extrapolate this figure into the future.

On the other hand, the profit figures over the three- and five-year periods might present a distorted picture, leaning towards the negative side. This could potentially be a reason why the stock is cheap today. The figures may not accurately reflect the company's performance, what could possibly be the reason why it is being ignored by investors.

While the revenue and gross profit show a steady increase, we observe a more fluctuating trend in operating profit and net profit. The acquisition of Nayan and the construction of the new factory, which also involved an expansion of the workforce, are certainly contributing factors to this variability.

Smartphoto already owns 8.9% of its own shares and recently initiated a share buyback program for €1.5 million, equivalent to 1.5% of the current market value. They clarify that these shares will be acquired as a potential investment or as a means for acquisitions and will not be canceled.

Over the past years, there has been a commendable growth in tangible book value per share and dividends. As mentioned earlier, while profits exhibit some volatility, they also show a positive long-term trend.

Risks

The most significant risks for Smartphoto seem to be largely in the past. The rapid decline in traditional photo items is slowing down and has less impact on the financials. The growth in personalized items is still ongoing. The market also appears stable, and it may not be easy for a new competitor to immediately provide the same user-friendly apps, fast delivery, and high-quality products.

I personally see the enormous year-end peak as a persistent challenge for Smartphoto. Everything must run perfectly during that time to avoid damage to their brand. In November, they generate double the revenue of other months, and in December, it's even five times higher. Managing this workload with temporary staff, who may not be as well-trained as the permanent employees, is a significant operational challenge.

If the bulk of the business is concentrated in the year-end period, a weaker consumer confidence can make or break the year. Given the current downturn in the stock markets, rising interest rates, and lingering concerns about high energy prices and inflation, consumers might tighten their spending.

Conclusion & valuation

Part of the confidence in the company is based on the belief that personalized products will always have a strong market demand. This sentiment applies to CEWE as well. Even though CEWE is currently cheaper than Smartphoto, the preference is for Smartphoto. This preference is rooted in the knowledge of the company's history and the commitment from its shareholders.

Furthermore, with the new factory, they have doubled their capacity, which will support future growth. In other words, they have made significant investments, and now they can reap the rewards, which is a positive aspect in an inflationary environment.

Another advantage is that Smartphoto is smaller, making it more dynamic and agile than CEWE, resulting in higher growth.

The acquisition of Nayan, with its expertise in e-commerce, is also highly positive for Smartphoto. Furthermore, it adds stability to the company's income throughout the rest of the year.

For me, this is not just a value play but an investment in a quality company that can be acquired at a fair price, ensuring a sufficient margin of safety.

There are various methods for valuing a company. For instance, we can compare it on a relative basis with competitors. In the column above, we see that CEWE is cheaper on this basis than Smartphoto. However, I've already explained why I prefer Smartphoto. Since there are not many more competitors and given the reasons stated, I am refraining from assigning a specific value in this context.

Another approach to valuation is comparing based on the company's historical performance. In this context, we observe that Smartphoto is relatively cheap today, with multiples (P/E, P/B, EV/EBIT, and EV/FCF) at the lower end of the range seen over the past five years. If we were to value based on average multiples, the resulting value per share would fall between €34 and €38.

Furthermore, it's worth noting that these are not inflated profit numbers.

If I calculate the replacement value, i.e., what someone would need to invest today to establish an equivalent business, I arrive at a value of €31.3 per share. However, this is likely an underestimate of the value, considering the brand value of Smartphoto and its authority in search engines.

Using the discounted cashflow method and assuming a growth rate of approximately 11.5% for free cash flow for the next five years (compared to the past five years, which was 27.6%), 6% for the subsequent five years, and then 2%, I obtain an intrinsic value of €43 per share. This is calculated with a required rate of return of 10% annually, not using the average cost of capital, which is lower and would result in a higher value.

Using the method taught by Bruce Greenwald, I even arrive at a value of €48.4 per share.

I consider the DCF value as the fair value because I believe that we are starting from a conservative basis with the current figures.

Despite its name, this is no longer just a photography company but an e-commerce business operating on technology and marketing, which will create many opportunities in the future.

I personally initiated my first position at €30.3 in July 2021 and added more later, resulting in an average purchase price of €31.9. Today the price is even more interesting.

Given that this is a relatively small company, with several major shareholders and many small, loyal shareholders, the liquidity of the stock is not high. This is also the reason why I am not adding more to my position today, as it would make my position too large.