Weekly: Portfolio July

Weekly 32 2025

This Week

Not even a full week since Thursday, but still a few updates over the past few days:

There was no noteworthy short news.

Since I’ll be on holiday for the next two weeks, there's not only a market overview but also a change in our top five of the month. This is in light of the portfolio’s concentration.

Doubler Portfolio Overview July 2025

For those not yet familiar with our Doubler Portfolio, read more about it here.

What a week, that last one of July. While positive and negative performances had been fairly balanced before, the final week was particularly weak.

Some of the declines were understandable, for example after weak results or outlooks. Others seemed to happen without a clear reason, and one was the result of poor communication from the company itself.

Summer trading often brings more pronounced market swings. That’s because trading volume tends to be lower, with many professionals on holiday.

The drop was broad-based, not specific to our portfolio or companies. In such cases, we’re not too concerned.

That said, it doesn’t automatically mean there are buying opportunities, even though social media was quick to respond with enthusiasm. The Buy-the-Dip crowd seemed eager to jump into action.

As long as our companies continue to perform well fundamentally—or in some cases, not worse than expected—these interim moves are of little importance.

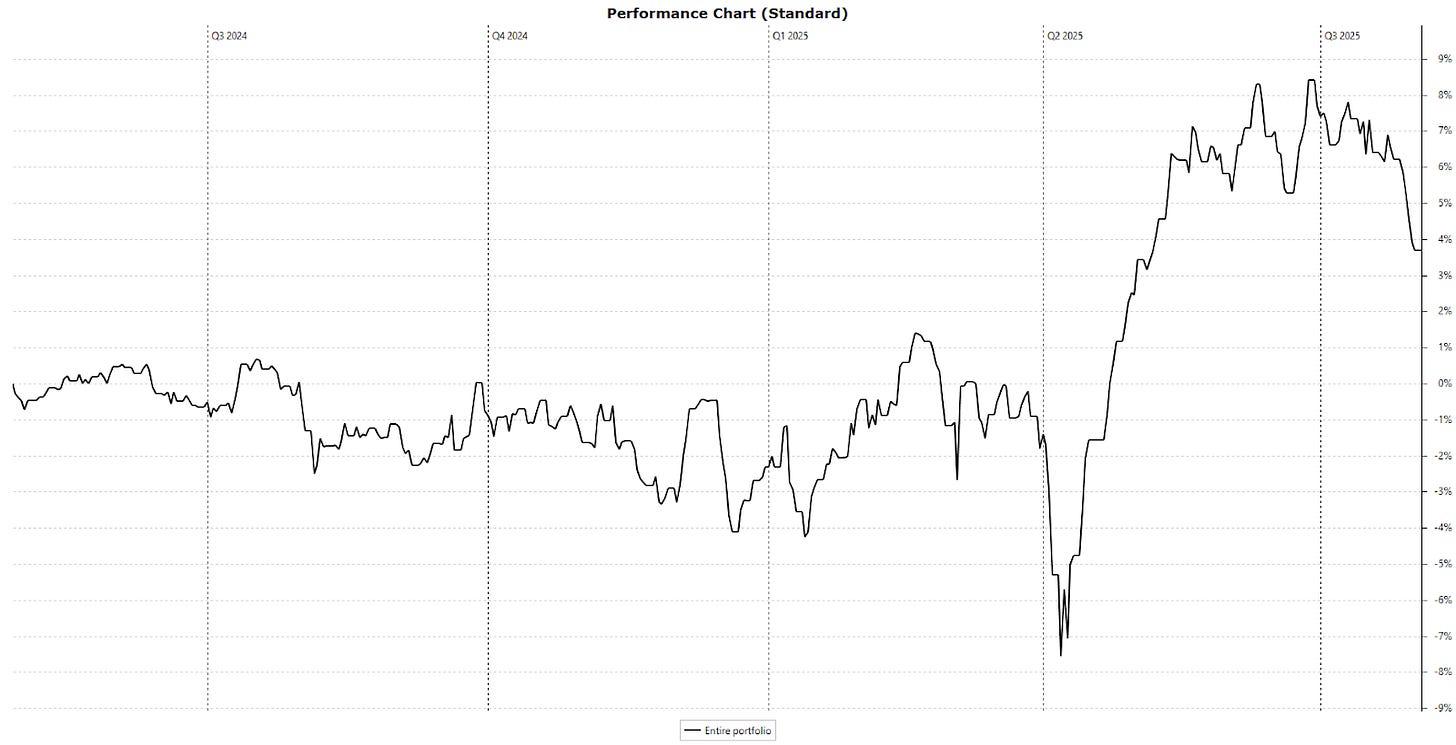

Still, it was nice to see the portfolio rising in previous months. July, however, brought a 3.5% decline, pushing year-to-date returns back down to 6.2%. We’ve moved a bit further away from doubling again.

July Recap

June was also volatile, but that month’s dip came in the middle, making it barely noticeable by the end. In July, however, the drop happened at the end, which clearly impacted the month’s closing figures.

If we had wrapped things up just one day later—after X-Fab’s results came out—the picture would’ve looked quite different.

In July, six stocks fell by more than 10%, although for most of them it was mainly due to profit-taking. Only Cake Box managed to rise more than 10%.