Weekly: Marketoverview July

Weekly 31

This week

This week we received the numbers from Stellantis, which I titled “Weak.”

There’s also Short News from Wickes, Semapa, Somero, K+S, and Exor.

After 31 straight weeks of publishing the Weekly and covering earnings, it’s time for a break. Next week, Weekly 32 will appear on Tuesday, and then I’ll be away for 2.5 weeks. The next weekly update will be published on August 28. Earnings updates will start appearing a few days before that.

Trade Deal with the United States

A trade deal was reached with the United States. Although the media and politicians expressed a sense of relief, it’s clear that Trump came out as the winner. Trump is constantly labeled a fool, so what does that say about our European politicians who negotiated this deal?

Honestly, I’m not too worried about the 15% import tariffs. Americans already prefer to buy American products when they can; only when quality or branding is better do European products come into play. That 15% won’t make much of a difference.

In the short term, of course, there will be an impact: this will weigh on orders and margins for European companies. But in the long term, this will just be priced in, and it’s the American consumer who’ll end up paying.

The dirty part of the deal is the LNG purchases. This is part of a plan set in motion years ago. Thanks to shale drilling, the U.S. suddenly had a surplus of gas. Massive export terminals were built to ship it abroad. The next step: make sure Europe stops buying Russian gas. That happened by supporting the war in Ukraine and by blowing up the Nord Stream pipeline.

This deal is the final piece of the puzzle—America now ensures that its excess gas will be taken off its hands.

That expensive gas from the U.S. is suffocating our industry. Industry needs cheap energy, and that’s just not possible with solar or wind alone.

Now that the U.S. has also proven to be an unreliable partner, Europe should consider making a deal with Russia. Just as untrustworthy—but at least it comes with cheap energy.

Market Overview – July

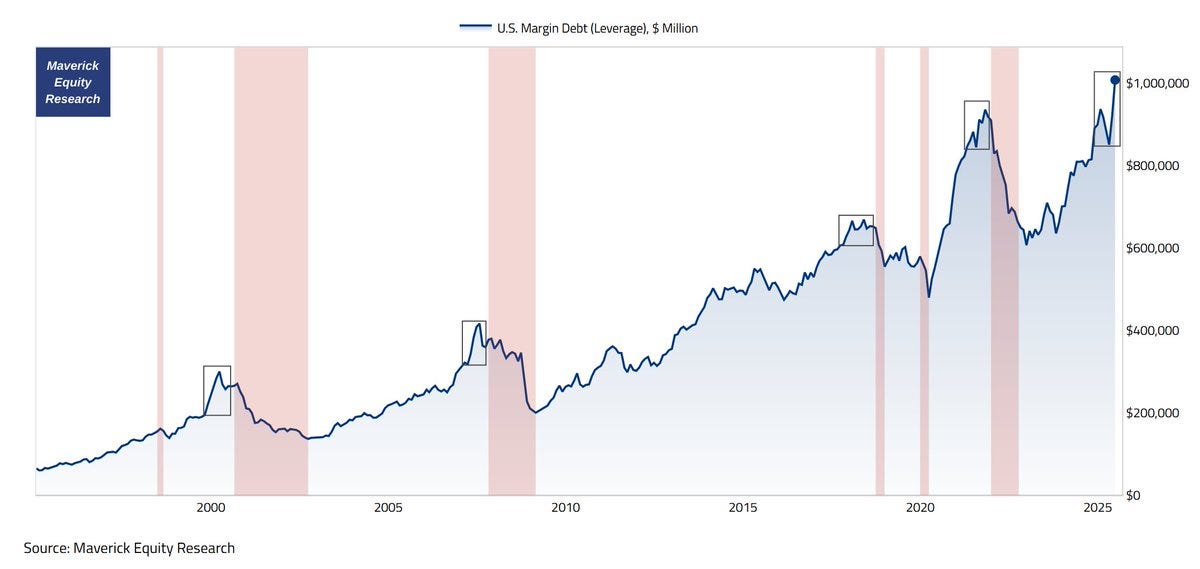

For July’s market overview, I could just show the following chart:

Of course, we should view this in light of inflation—rising amounts aren’t surprising. But even adjusted for inflation, this is still a record. Using data from Inflationcalculator.com, the peaks in 2000 and 2008 (in today's prices) were 25% lower than today. Even 2018 was about 20% lower.

The chart also clearly shows what always happens after such a peak. The drops in 2018 and 2022 were relatively short. Since 2020, what stands out is how fast the increases have been. That’s why I wonder if we should see 2022 as just a temporary dip in the ongoing bull market since 2020—or not.

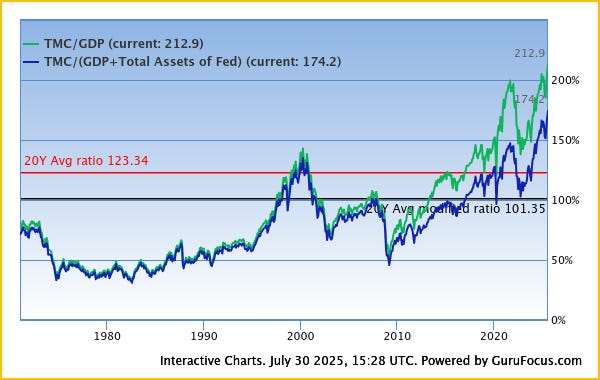

No matter which metric you look at, everything points to a heavily overvalued U.S. market.

Just look at the concentration in the S&P 500: ten companies now make up 38% of the index. We saw this same phenomenon in 2000 and 2020.

Forward P/E ratio? It was 25 for the S&P in 2000. Today it’s 27. That makes the S&P more expensive now than during the dot-com bubble—a time when investors didn’t even care if companies were making a profit.

Both the Buffett Indicator and the Shiller PE have been warning for some time that the market is overheated. The Buffett Indicator has already passed its previous high.

Meme stocks are also back. After GameStop, it’s now OpenDoor’s turn. Add to that the record levels of insider selling, and I think we’ve got enough evidence to say we’re in a full-blown runaway bull market.

Can it go higher?

Yes, of course it can. The VIX, also known as the fear index, remains historically low—suggesting there’s little nervousness in the market. Companies are still buying back their shares in large amounts, and especially the tech giants still have plenty of cash.

Even though the VIX is low overall, we’re seeing extreme movements based on good or bad company news—signs of a market obsessed with the short term.

We’re at a point where many investors feel invincible. “Buy the dip” has worked multiple times now, so they plan to keep doing it.

This euphoria can last as long as there's cash to be found—whether it's savings or borrowed money.