Weekly 45 Portfolio overview October

Weekly 45 2025

Is This the Last Straw?

OpenAI has asked the US government to guarantee their loans. The reason, they claim, is that what they are building should be considered critical infrastructure.

OpenAI has now finalized numerous deals and must be able to repay more than a trillion dollars (yes, $1.000 billion, or one million million dollars) in the future. They won’t generate that money from revenue, as they are even losing money on their corporate customers.

When a pro-AI journalist asked Sam Altman (CEO and founder of OpenAI) how they were going to pay for all of this, he reacted defensively. His answer was that if he were looking for someone to buy shares, he’d find someone. The core of the question was left unanswered.

The parallels with the build-out of the American railway infrastructure are becoming significant because of this. After all, those initiatives also brought extra productivity and lower costs.

Here is what Google Gemini said about that period:

The Railroad Boom and Bust

The period from 1800 to 1900 saw a massive expansion of the railway network in the United States. This was crucial for economic development, as it drastically accelerated and lowered the cost of transporting goods (like agricultural products and raw materials) and people over long distances.

The Boom

Huge Investments: Enormous amounts of money were invested in building new lines, often by private companies. These companies sold shares and bonds to finance their projects.

Speculation: There was significant speculation (gambling) on the future profitability of these railway companies. People bought shares, sometimes even though the companies were not actually profitable, purely in the hope that the value would continue to rise.

Lack of Regulation: There was little to no government oversight on how companies structured their finances or how shares were traded.

The Bust

This unbridled growth led to a ‘boom and bust’ pattern:

Overbuilding: Too many lines were built, sometimes in places with little economic transport demand.

Bankruptcies: When the expected profits failed to materialize, or when financial scandals came to light, investors lost confidence. This caused stock prices to plummet and many railway companies to go bankrupt.

Stock Market Panic: Because the railroads were such a large part of the economy, the failure of major companies caused panic on the stock exchanges (such as the Panic of 1873 and the Panic of 1893). Investors sold off other stocks en masse out of fear, leading to broader economic recessions.

In short: Unchecked, often unprofitable, but heavily speculated railway expansion led to financial bubbles that, once burst, caused widespread panic and economic crises.

Unsustainable

And now, Sam Altman is asking the American taxpayer to foot the bill if they fail. The profit is theirs, but the loss is for the taxpayer? Would even Trump approve of something like that?

In any case, it’s clear that this situation is unsustainable.

Let’s end with a quote from Charlie Munger (albeit about a different period, but very applicable right now): “If you’re not afraid, you’re not paying attention.”

As I’ve written a few times, the winners of AI will be the AI companies themselves to a lesser extent; it will become too commonplace of a product. Suppliers of infrastructure equipment like NVIDIA will be making tons of money now, but will later settle back down to a lower level.

The real winners will be those companies that implement AI well and thus boost their margins. However, this is still in too early a stage. Just as the railroad companies were not the winners of the railway expansion, but the companies that could suddenly transport their products much cheaper across the entire country.

Doubler portfolio overview October 2025

For those not yet familiar with our Doubler Portfolio, read more about it here.

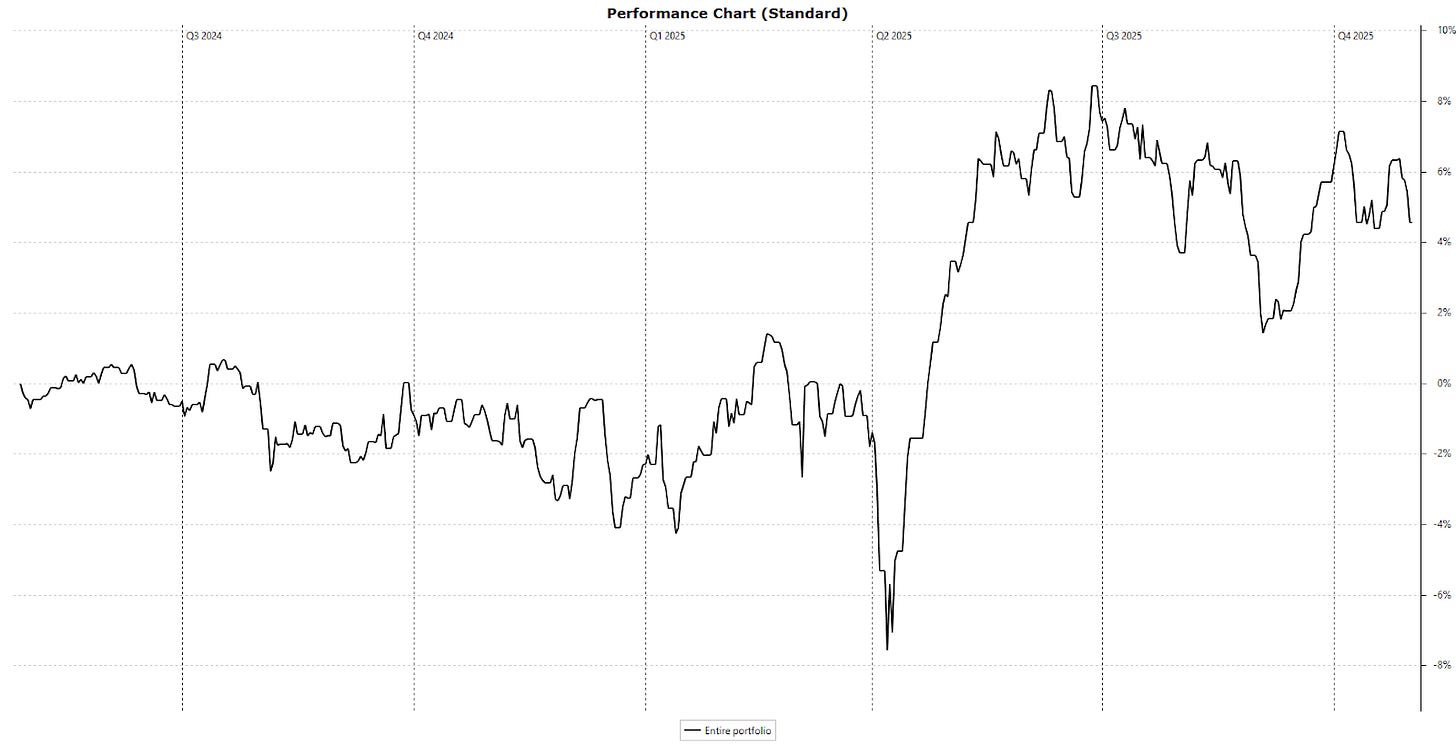

In October, the portfolio gave back 1.1%, bringing the year-to-date result at the end of October to 7.5%. What strikes me most is that the portfolio moves very independently; there is little resemblance to the indices. That’s a positive over the long term, but it’s less pleasant during a period when the S&P 500 continues to explore new highs.

In the long run, however, it’s a good thing that movements on the exchanges don’t have a direct impact, because we see the overvaluations rising. This is only in a relatively small selection of stocks, but those stocks are defining both the S&P 500 and the World Index. So, what now seems like a disadvantage will prove to be an advantage.

If the human factor were to disappear from the stock market and prices became rational, the price of a company would reflect its value. Given the results of our companies, that would be a huge advantage. Unfortunately, that human factor remains decisive, and for now, we’ll have to be satisfied with the 7.5% since the start of the year.

On the other hand, I’m actually very glad that the human factor will never disappear, because fear and greed are the factors that make value investing work. In times of greed (or the fear of missing the boom), it seems like it no longer works. This causes everyone to look for different places, which gives us the opportunity to keep finding bargains.

At other times, when panic strikes the entire exchange, we can pick up quality companies that are too expensive at all other times.

In that latter situation, you go for absolute quality and don’t have to look for a possible catalyst to drive the price. This wasn’t necessary during the boom times in the past either: if something was cheap enough, it would eventually be discovered by active investors.

Now that we, as active investors, are becoming increasingly rare, this discovery, purely based on how cheap something is, has become less relevant, and we need to make more thoughtful purchases.

For this reason, and with the feeling that a period of panic is approaching, I’ve become even more selective in my purchases. This stands in stark contrast to the many messages I read from other writers, with their lists of “X number of stocks to buy now.”

I consciously prefer to maintain a strong cash position, which currently stands at 27% and will be almost 34% after the sale announced below. 1/3 of the portfolio is too much. I want to bring this back to 20-25% through additional purchases of existing positions and new ideas.

I am turning over a lot of stones, so if you have any suggestions for stocks you strongly believe in, I’d love to hear them.

October Performance

Despite the decline, October was a relatively calm month with few extreme movements in our portfolio. Only two stocks had a movement greater than 10% in October: one negative and one positive.