Weekly 43: Marketoverview October

Weekly 43 2025

The market overview is coming a week early this month. There will be no newsletter next week. Unfortunately, this isn’t for a holiday, but it is a calm week for company news in our portfolio, and I’m heavily engaged in working on improvements for Valuing Dutchman. Unfortunately, this has to be done by a one-man army, which is why there will be no newsletter next week—it’s so I can speed things up.

Market Overview - October

The situation is still the same as in recent months: the US market as a whole is strongly overvalued. This is being driven by AI stocks, which we can now cautiously start calling a bubble. But the other stocks are certainly not cheap anymore either.

The consensus among both institutional and retail investors seems to be: “Okay, the market is expensive, but we’re on the verge of a blow-off top.” In other words, they expect a massive final surge before the market moves lower again.

I dare not predict such a thing. I have no idea why we would go much higher first, or, conversely, what the reason would be to forecast a downturn right now. However, if we look rationally at the prices being paid for stocks, the expected return on those investments is getting smaller and smaller.

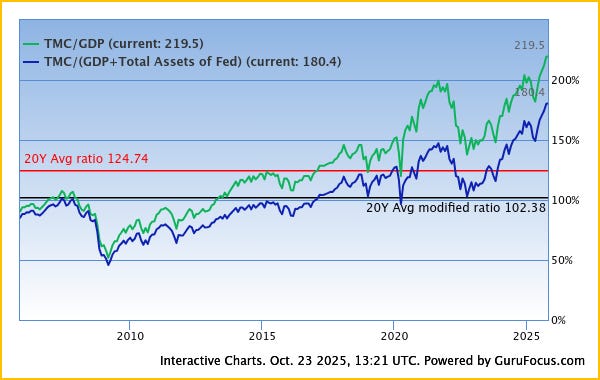

According to the Buffett Indicator, the expected return for the US market is even -0.6% negative, including dividends.

We are firmly in the “Be fearful when others are greedy” territory today, because anyone buying those expensive stocks in full force at these prices is being greedy.

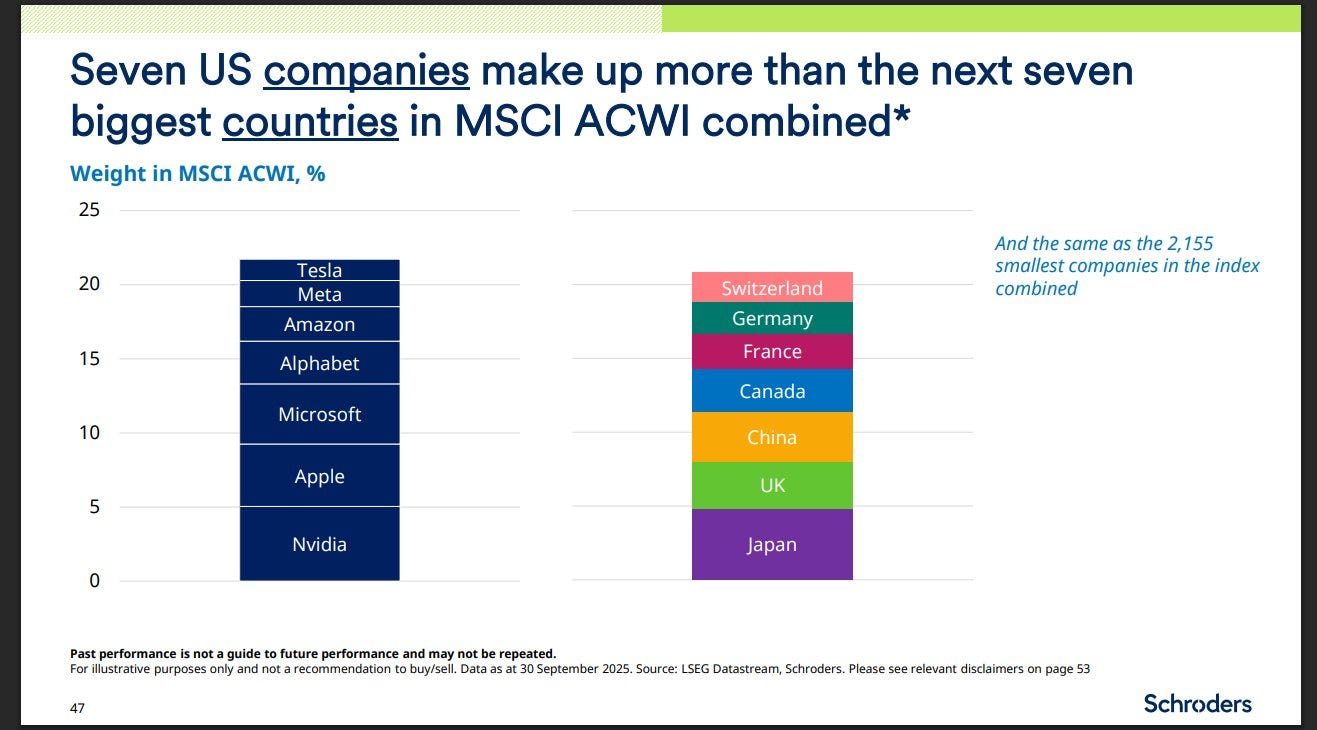

I’m repeating myself, but those who invest passively are also heavily buying these expensive stocks today. Your diversification is no longer optimal, as the Schroders chart below clearly illustrates.

In the MSCI ACWI World Index, the seven large US stocks have a greater weight than the next seven largest countries combined. Nvidia’s weighting, in particular, is enormous, accounting for about 5% of a global index.

And while these seven companies are probably too expensive, they aren’t even the biggest problem. Schroders had a much more interesting chart.

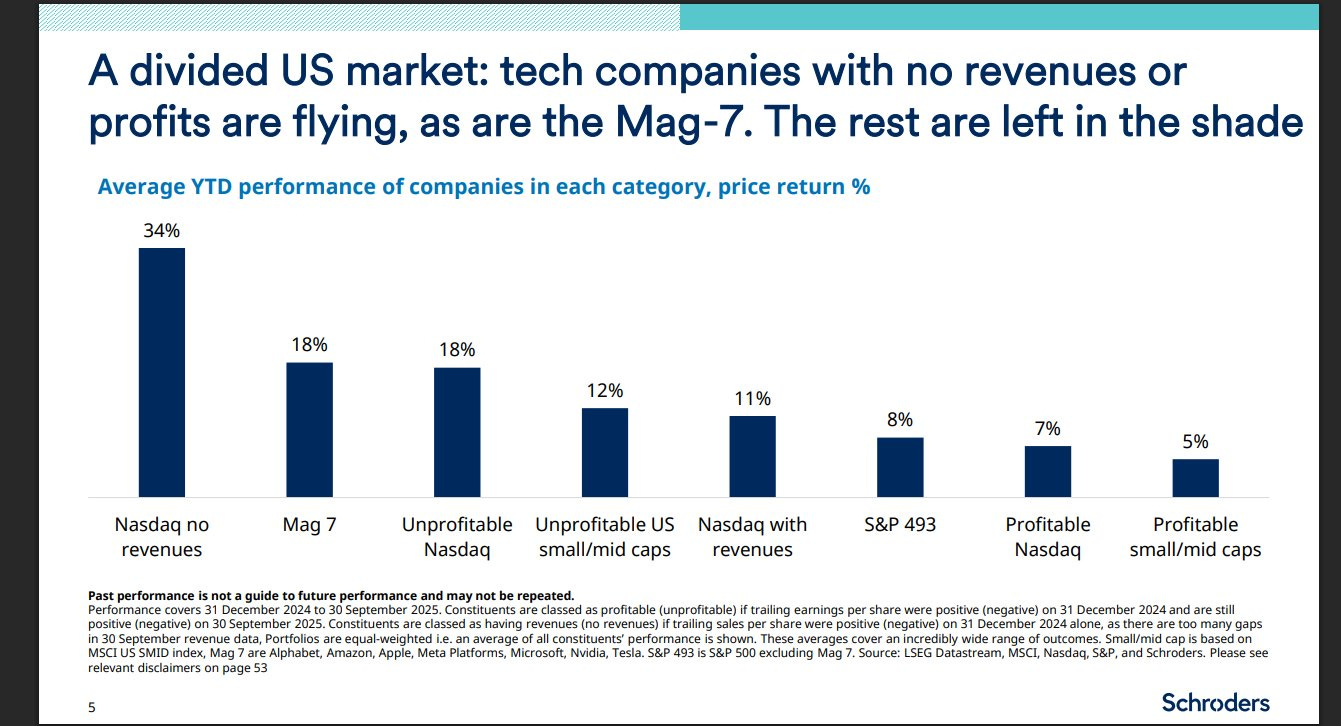

These seven stocks realized an annual return of 18% on already very high prices, but the stocks on the Nasdaq, the technology exchange, that generated zero revenue (yes, you read that correctly: zero revenue) rose by 34%. Loss-making stocks on the Nasdaq rose 18%, while loss-making small-cap US stocks rose 12%.

On the opposite side, we see that profitable stocks on the Nasdaq rose 7%, while profitable small and mid-caps could only manage a 5% increase.

This, again, is clear evidence that investors today are investing in dreams. Some of these dreams will come true, but the majority will not.

The hunting ground for the US stock investor is clearly in the profitable, smaller stocks. And their European counterparts are even cheaper, mainly due to political concerns.

Now that we have provided our portfolio with a sufficiently large cash buffer, it’s time to look for new stocks and see if they can replace existing positions. I’m keeping the cash buffer as insurance.