Weekly 41: We are ready!

weekly 41 2025

I’m sharing a snippet from our fund’s quarterly letter below. I had prepared a piece on the spectrum of value investing and the various styles within it, but I’ll save that for next week. I feel the message below is far more critical, and even though it’s a bit of a repeat, I’m going to keep hitting this same nail on the head.

My goal today isn’t to sell subscriptions, but to make sure there are still enough people interested in the stock market a year or two from now (so I can sell subscriptions 😉). I want to prevent them from becoming so disgusted that they stay away from the market after following all sorts of “buy tips” (which I have huge question marks about right now) and losing a decent chunk of their capital.

The stock market is truly for everyone, and it’s the best way to preserve and even grow your purchasing power, provided you have the necessary patience. The prerequisite, though, is consistently maintaining a rational perspective on the market. Warren Buffett taught us that it’s not our intelligence that gets us into trouble, but the control over our emotions. For me, controlling those emotions comes from staying rational. And since you’re still reading this newsletter and haven’t hit the unsubscribe button, that tells me you want to remain rational, too. Here’s what I wrote:

Is This the Calm Before the Storm? We definitely have that feeling. We won’t bore you again with how expensive the US stock market is, or how investors today are only focused on buying and quick price increases, completely forgetting that the market can also fall.

You’ve probably noticed it yourself with family, at parties, or at work: the conversation is increasingly shifting towards investing. When I recently went out to eat with ‘the guys’ (all childhood friends), I couldn’t help but eavesdrop on the table next to us. It was also a group of men, in their thirties, having a heated discussion about stocks, crypto, and investing. I’ll just add as an anecdote that the content of their discussion was often based on incorrect information.

I’m noticing it personally, too. When I meet new people now and they ask what I do, it leads to a whole conversation, often focused on their most profitable positions. Six years ago, when I mentioned I was a full-time investor, there was often a dead silence, and the topic quickly changed.

This calm before the storm can go one of two ways, depending on where we are in the cycle right now.

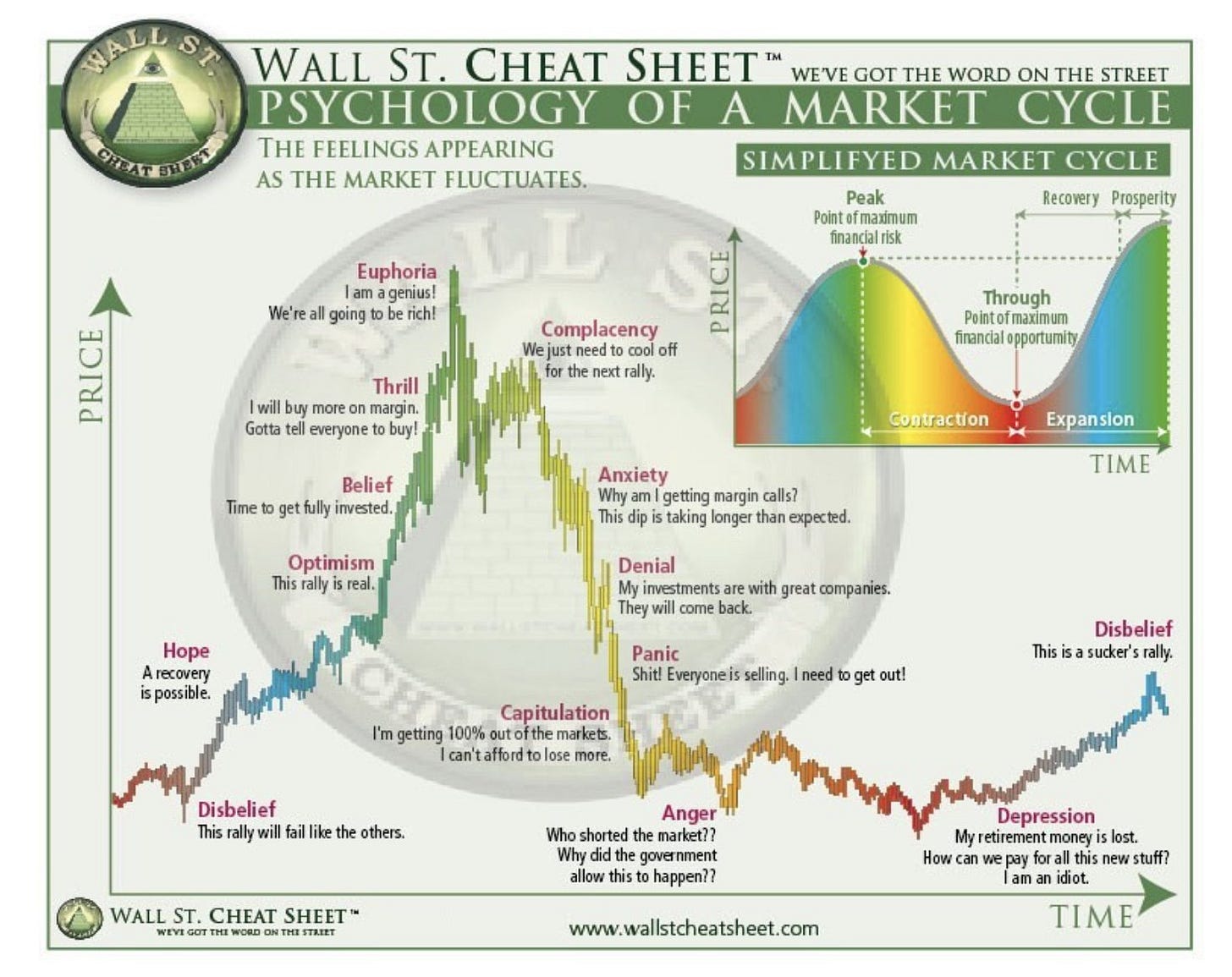

It seems pretty clear that we’ve already blown past the Optimism and Belief phases (see the chart below). Thrill might still be a possibility, but Euphoria seems more likely. Or was the dip in April already a sign, and are we now settling into Complacency?

Accurately predicting our exact position is unfortunately impossible; that’s why they say you can’t time the market. However, it’s enough to know we are roughly in that general area. We are right up against the peak of a market cycle, regardless of the exact stage.

For many investors, such a peak often feels like the safest point. Everything is going well, profits are soaring. But this is, in fact, the most dangerous point in the cycle because prices are high relative to valuations, which means there’s a real risk of loss. The moment we hit Anger or Depression, nobody wants to invest, yet those are paradoxically the safest periods in the stock market.

As Howard Marks says: you can’t time the market, but you can prepare for it. Knowing roughly where you are is sufficient to make those preparations. For value investors, that usually means: selling shares that have run up a bit and being highly selective with new purchases. Only open new positions if you believe there’s a reason for them to rise in the short term. You need a so-called catalyst—a reason for the stock to be “discovered,” such as a takeover, a merger, or something similar.

Buying a stock just because it’s cheap and counting on a return to the mean is simply not the right play in this market phase. And yes, there are certainly still many cheap stocks to be found, especially in Europe, but if the bubble in the S&P 500 bursts, those cheap stocks will also take a hit.

Sleeping like a baby

We’ve already started making some opportunistic sales, even of stocks we believed we were still selling below their intrinsic value. We also exited Kamux because the crisis in the car market is causing a major shortage of used cars, which is what consumers actually want to buy. For now, consumers are still avoiding expensive second-hand electric vehicles. Simply put, we don’t see a catalyst to drive the price towards its intrinsic value in the short term (which, for us, means between now and three years).

We’ve previously calculated how the mechanism of a cash position works during market downturns, but we’re happy to repeat it.

Imagine you have a portfolio of €250,000 that is fully invested. If your stocks drop by 50%, you’re left with €125,000.

If, instead of being fully invested, you had €200,000 invested and held €50,000 in cash, your portfolio would be worth €150,000 after the decline. So, cash is a significant buffer when the market crashes, even if it’s only 20% of your portfolio.

But the best part is yet to come: you can invest that €50,000 in cash after the 50% drop, allowing you to buy at rock-bottom prices and then benefit extra from a recovery.

When the market eventually returns to its original level in the following years (a 100% rise!), the first investor without cash just gets their €250,000 back. The second investor, who bought at the bottom with their cash, now has a portfolio worth €300,000.

The first investor has a 0% return, while the second investor realized a 20% return on their total portfolio. Same market movement, same investments, but it’s the cash that makes all the difference.

50% seems like an extreme example, but it’s not. In my investing career (since 1999), I’ve seen declines of over 50% happen twice.

Not the Dot-com Era, But Still...

I often read now that the current situation is completely different from the dot-com bubble. The difference is, of course, that today the strong tech players are largely footing the bill for the bubble, whereas the dot-com era was mostly hot air.

But let’s look at this rationally again. The Felder Report shows the following: Total investment in AI infrastructure in the United States is expected to exceed $500 billion in 2026 and 2027—comparable to the GDP of Singapore. However, US consumers are only spending $12 billion on AI services, which is roughly the GDP of Somalia. When you look at the difference between those two countries, it becomes incredibly clear.

It’s obvious that these expenditures cannot be rationally explained in any way. AI is a fantastic evolution, but just like all the others, it’s currently being driven by excessive euphoria. Future sales and profits simply cannot be high enough to justify these investments.

I’ve read the argument that it will save so many employees and is therefore justifiable. Will AI companies be able to pass on 100% of that efficiency gain to their customers? Of course not, because then the customers would just keep their staff. Those customers/companies need to benefit from it themselves. And honestly, I don’t see any current application delivering such massive efficiency gains yet.

What we do see are increasing circles where the AI bubble is self-funding, which is perfectly summarized by this meme.

The math doesn’t add up, and sooner or later, this realization will hit everyone. Then it will be a stampede for the exit. I asked the question on X this week: Is no one wondering how OpenAI is going to pay for all of this? And no, no one seems to be asking that question.

Do you remember the story of Theranos, which was brilliantly dramatized in the series The Dropout? The party lasted so long there because no one asked if the product even worked. Here, it’s time to ask the question: Who is going to pay for all of this?