Weekly 40: Opportunities are coming; be prepared

Weekly 40 2025

As always, things got quiet on the corporate earnings front at the end of September, while we wait for third-quarter results. That gives us some time to prepare for what’s ahead.

Towards the end of last year, I wrote that my resolution was to move “towards positivity.” However, over the past few weeks, it may have seemed like I was constantly playing the doomsayer, simply because I was urging caution.

Let’s take a positive approach to this. As Howard Marks puts it: we can’t time the market, but we can prepare. That preparation means being highly selective with your current portfolio. It means selling stocks whose price is above their real value, and being equally selective with your new purchases.

Right now, simply buying something because it’s undervalued isn’t enough. You need to have visibility on a reason why it will rise in the relatively short term (between now and three years). The chance of a further multiple expansion, or even a return to average multiples, is very slim in an already overheated market environment. If it hasn’t happened yet, why would it happen in the near future?

That’s a reality we have to deal with today. Our cheap stocks need a so-called catalyst before they’ll climb in this market. After a crash, or in a less overheated market, simply being cheap and getting discovered can be enough. A catalyst could be a major party taking a stake, a takeover attempt, a merger, and so on.

The likelihood of our inexpensive stocks being discovered today is relatively small. Everyone is chasing the same shares, which is evident in the prices. Or people simply don’t care and buy ETFs that track the indices, which amounts to the same thing: you’re buying what’s already popular.

However, if you want to do better than the market in the long run, you can’t do the same thing as all the other investors. If you do, you might as well just buy those ETFs.

Doing things differently today means not chasing prices and being careful. Holding cash aside and getting ready to deploy it when the odds are in our favor.

To get those odds as much in your favor as possible, you also need to be prepared about which stocks you want to buy when prices drop.

If a real crash comes—not just a brief dip—it will be reflected in the economy. There will be layoffs, and companies will run into difficulties. The goal then isn’t to deploy our cash on the companies we think will be the next big hype. Instead, it’s on rock-solid businesses that can weather such a storm and profit from the disappearance of competitors: the strongest in their segment. Think more along the lines of the Jensens of this world, not the Nvidias. Not that Nvidia isn’t currently the strongest, but the narrative driving its current stock price is precisely that it has no significant competition. They can’t exactly emerge stronger from a crisis if they had no competition to begin with.

Safeguarding our cash position is already done—that was step one of our preparation. Scrutinising our existing positions is what I’ve been doing for a few weeks now—that was step two. This is a continuous process, but we’re being even more critical now.

Step three, which was running simultaneously with the first two, is identifying the stocks we want to buy. That’s work happening behind the scenes, but it’s far more important than any other message I could write for you. Because I’m an investor, that’s where I place my priority.

As I’ve written before, I don’t like bringing bad tidings. I’m a true optimist. And that optimist tells me great opportunities are coming. We just need to have the necessary patience and not give in to FOMO (fear of missing out).

Doubler Portfolio Overview July 2025

For those not yet familiar with our Doubler Portfolio, read more about it here.

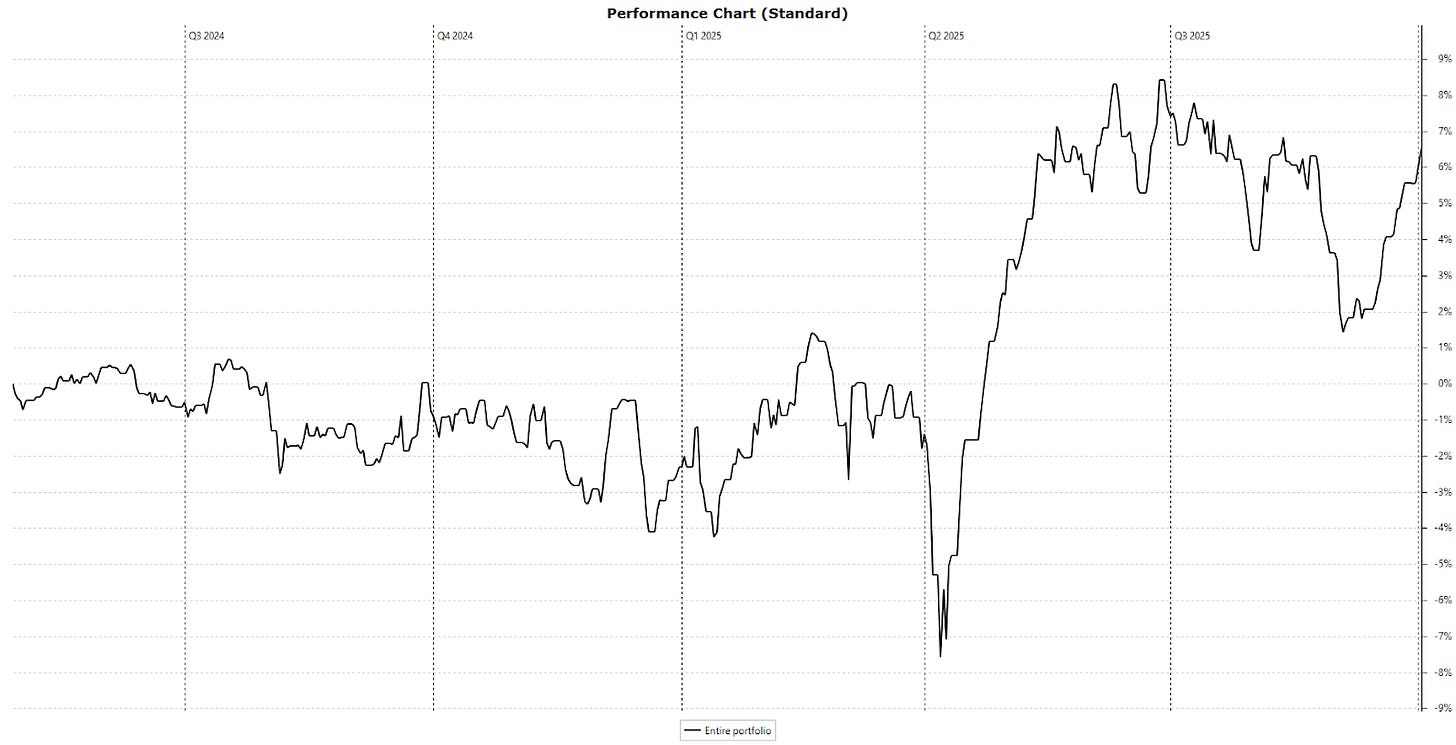

September saw the portfolio recover from the drop in July and, to a lesser extent, August. The first two days of October were good as well. We haven’t quite reached the late-June peak yet, but we are back up to a 9.2% gain year-to-date. And that’s with a portfolio that’s only 74% invested.

That 26% insurance policy in cash is costing us a bit of return for now, but as I wrote before, it’s a sacrifice I’m more than willing to make. In fact, later in this newsletter, you’ll see another sell order where we lock in a 50% profit by selling a company that hasn’t even reached its real value yet. That’s how much importance I currently place on cash.

Our portfolio rose by 2% in September, bringing the result from January to the end of August to 8.2%. As I said, we can’t complain about that return, especially being only 74% invested. The most important thing, though, is that I sleep soundly thanks to that cash position, knowing that when the time is right, I’ll have the firepower to strike.

I’m particularly curious about what the trigger will be that finally brings investors back down to earth and, hopefully, causes a massive panic. Last month, it briefly looked like the debt concerns of various countries might kick things off, but now we hear nothing more about those issues in France (or other nations). Even the US government shutdown was met with a collective shrug.

An argument I often read for why the crash won’t happen is that everyone seems to be expecting it. Well, not everyone. That’s obvious if you look at the stock prices. As full-time investors, we often forget that not everyone is on top of the market like we are. There’s a huge crowd that barely pays attention and is quite proud to be “couch potato investors.” Professional parties often have no choice but to stay invested, either due to regulatory rules or internal policy. Deviating too much from the benchmark can cost them their job.

So, in my view, it’s entirely possible we’re heading for a crash that “everyone” saw coming. When I first started investing in 1999, I couldn’t understand what was going on either. I was immediately pushed in the right direction (which I unfortunately deviated from between 2002 and 2004) and was constantly reading about the internet stock bubble. Even then, it seemed to me like everyone saw it coming. It just depends on where you’re looking.