Weekly 39: Buying Your Own Revenue?

Weekly 39 2025: Market overview

Company News: This week, we’re focusing on Brederode, Trigano, Sofina, and Ackermans. Plus, we’ve got an announcement coming up about another transaction in our ‘Doubler Portfolio’.

Buying Your Own Revenue?

A few weeks ago, I briefly wrote about how bizarre it was that Oracle stock jumped so much after the announcement of that massive OpenAI order—a $300 billion deal that OpenAI can never pay for without raising extra cash. This week, Nvidia announced they are investing $100 billion in OpenAI.

Let’s just take a sober look at this:

OpenAI orders $300 billion from Oracle, and Oracle’s stock rises 36%.

Oracle runs on Nvidia chips (for now) and will need to buy billions worth of chips from Nvidia.

Nvidia announces they are investing $100 billion in OpenAI. Nvidia’s stock climbs on that news.

So, Nvidia invests $100 billion in OpenAI—money that OpenAI will use to pay Oracle, which will, in turn, order Nvidia chips. All while Nvidia is an investor in OpenAI... The circle is complete.

For now, the added value of OpenAI is negative, as they are generating considerable losses. The competition is massive, and the costs for data centers are in the same league, making it unclear how they will turn a profit. Often, it’s not the first movers in such technological shifts who end up cornering the market. Will that be the case for OpenAI?

When the return on an investment is this uncertain, you can really only see one thing here: Nvidia is buying its own revenue. I have serious questions about that.

The AI hype is, for me, complete. Just like the dot-com bubble during the rise of the internet, I believe AI is also a technological advancement that will change the world. Anyone who denies that simply hasn’t made enough use of the tools available today.

However, in my opinion, the big winners won’t be the providers of the AI solutions, but rather those who can implement it effectively. By that, I mean both the implementation companies bringing it to other firms and the companies where it is successfully implemented.

Since the Industrial Revolution, there’s been a very long list of technological improvements, each groundbreaking and world-changing, but none have been enough, to date, to justify valuations like these.

It’s entirely possible that AI will change the world and, at the same time, the AI companies—and even the entire US market—are heavily overvalued.

Market Overview

The Shiller PE broke through 40. It’s only been higher once before (42): during the dot-com bubble. Regardless of how massive the change AI brings will be, these valuations simply can’t be justified anymore. Every time we’ve seen such an overvaluation, the following decade has been weak. The Shiller PE indicates that for the next eight years, assuming a return to the mean, we should expect a return of about 1.6% per year.

The increase in companies going public is also a clear signal that we are near the top. I’m deliberately vague with ‘near’ because what is expensive can always get much, much more expensive.

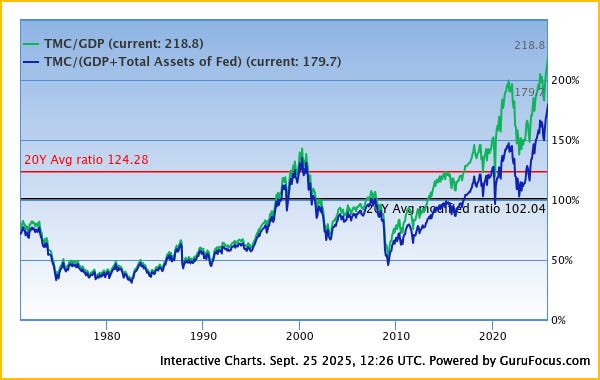

All US indexes hit record highs this past week, even the Russell 2000, which contains the smaller stocks. The Buffett Indicator suggests a market expectation of -0.7% for the coming years, including dividends.

I’ve pulled out the maximum term Gurufocus allows for the chart above. You can clearly see that we are massively above the twenty-year average, but even that twenty-year average is already 20% above the adjusted average. Honestly, how many more signals do we need?

Why Should We Care?

You might wonder why we should worry about the valuations of the US stock market. After all, we invest in Europe in individually selected stocks, not in the US or global index.

The answer is sentiment. In the short term, the stock market is driven by emotion, which explains the extremes, both up and down. In the longer term, value always surfaces. At these prices, I just don’t understand anyone buying indexes or ETFs anymore.

And then we’re seeing other parts of the market starting to get pricier. I want to own assets that yield something. Think of real estate that generates rent or companies that make a profit. I don’t know how to value assets that provide no economic return. What, for example, is the value of Gold or Bitcoin? I’m not saying they are bad investments. Gold has been the measure of money for centuries and is certainly a protection against currency debasement. But how do you calculate their future value? Even with Bitcoin experts, I haven’t managed to figure out a clear way to value it.

I want companies whose future profits I can forecast with a decent amount of certainty. I don’t want to overpay for those companies, and I want them to have rock-solid balance sheets so they can weather the future storms that are definitely coming.

Today, such bargains can certainly still be found in Europe, but when the US markets start to fall, sentiment will shift. Then our European bargains will almost certainly become even cheaper. Hence the balance between cash and investments.

This is probably getting annoying—it feels that way for me to write it too. I really don’t want to be a doomsayer and mostly want to focus on the future. That’s what attracts me so much to investing and companies. You really need to be able to see a rosy future and believe in the ingenuity of humanity, otherwise you wouldn’t make a single investment.

The belief in the future and the fact that you are constantly learning are the factors why I will always keep investing. We must, however, continue to approach investing sensibly and rationally. When we see excesses, we need to become more cautious and make sure we are prepared for the times ahead.

The saying “Be fearful when others are greedy and be greedy when others are fearful” by Warren Buffett has been brought up constantly in recent years to justify purchases every time there was a small dip. I’m not using it today for the second part of the saying, but for the first. It’s truly time to become a little more fearful, or rather, cautious.

We have to rationally recognize that the best opportunities in the stock market are not here today, despite all the buying tips and visions of insane wealth you see passing by. Always ask yourself what the incentive is of the person sending those messages out into the world. As Charlie Munger said:

“Show me the incentive and I’ll show you the outcome.”