Weekly 36: waiting

Portfolio overview August, Weekly 36 2025

This Week

Last week, we took a look at the results from:

Under Short News below, you'll find a summary of the results from Ackermans & van Haaren and Hal Trust. A busy week indeed, but first, let's check in on how our portfolio performed in August.

Doubler Portfolio Overview July 2025

For those not yet familiar with our Doubler Portfolio, read more about it here.

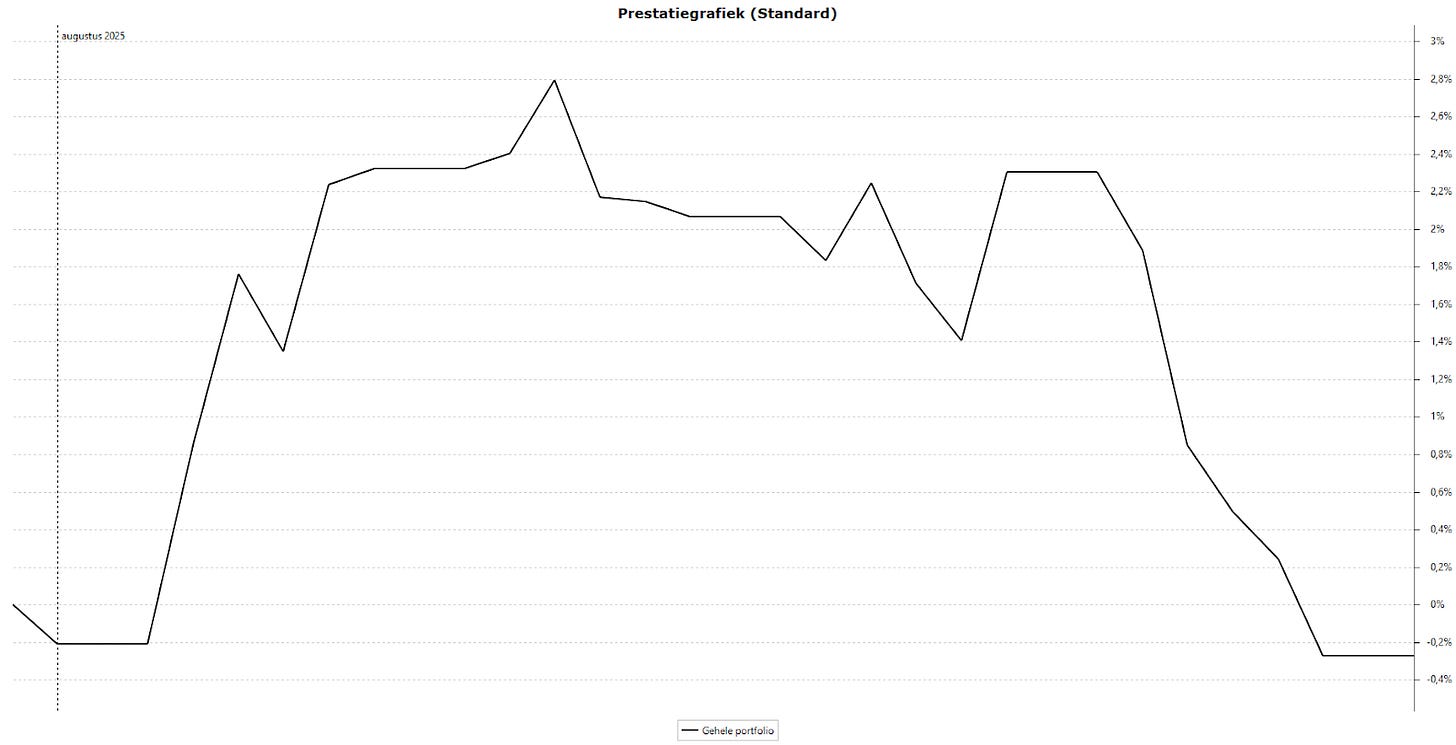

It seems to be becoming a bit of a pattern: a rise in the first half of the month, followed by a stabilization, and then a significant drop in the last week or couple of days. We already saw this in July. If we zoom in on the August chart, here’s what we see:

We ended August 0.3% lower than where we started the month. It was largely a non-event, although the decline has continued into September so far.

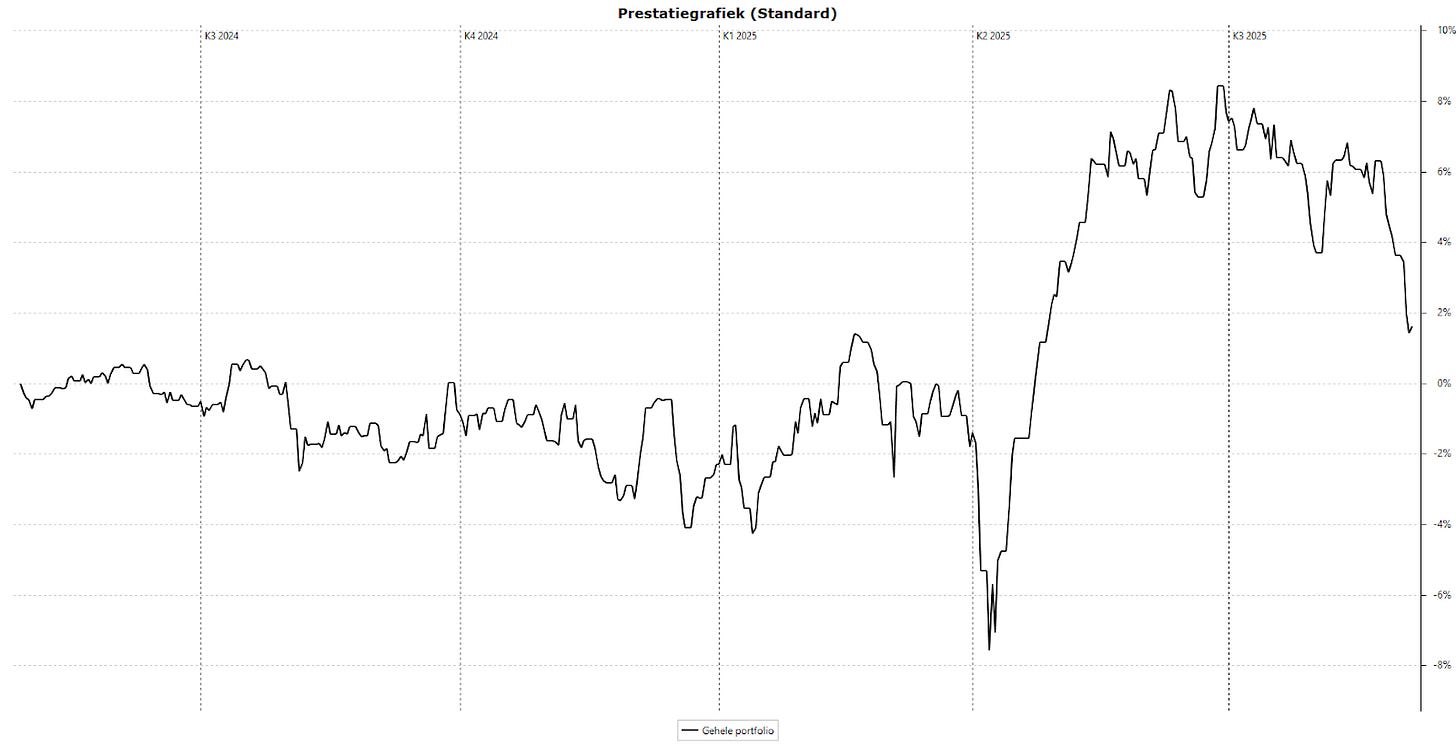

The year-to-date result through the end of August is 6.1%. Since we started in late April of last year, that's 3.6%. I'm not exactly getting wild about it, but we still have 30% of our portfolio in cash. We know that 'time in the market' is more important than 'timing the market,' and yet, it's a deliberate strategy to hold this much cash. In the short term, holding so much cash weighs on returns, but if we deploy that cash well when the time is right, we'll more than make up for it.

It's not that I'm trying to time the market; nobody can do that. What you can do, however, is keep your eyes open to the valuation of the stocks that make up 'the market.' In doing so, we see everything from correctly priced to very expensive and very cheap stocks. However, those cheap stocks are usually cyclical, and our portfolio is already well-stocked with them.

Quality companies are no longer cheap today, or you're already paying a steep price for potential future growth. Let that be the difference between why I call myself a value investor and not a quality investor: I only want to pay for what I consider 'as good as certain' and not for future promises.

I've also been at this long enough (active in the stock market since 1999) to know that we are now in an exceptionally long period of rising markets without any real major corrections. I've written it before: even someone who has been active for 15 years hasn't yet felt the pain of a real, prolonged correction or crash.

That a correction is coming is certain; only the timing isn't. As long as the market is rising, I will continue to be 70% to 75% invested, and I will be more on the selling side than on the buying side.

Debt Worries

Currently, there's unrest about the spiraling budgets and rising debts of various countries. Especially in France, they seem to be suddenly waking up and realizing that it can't go on like this. Hopefully, that sense of realism will also follow in Belgium and this awareness will be put into practice. We've seen in Argentina that it's possible.

In the bigger picture, the eurozone is still in good shape compared to other major economies, such as Japan and the United States, when we look at debt. There are problem countries, but as a whole, it's manageable, provided the cooperation remains intact. The big worries lie in the aging population, the migration issues, and expensive energy.

It's clear that tough measures will be necessary; for example, I'm not counting on a pension. The next easy step, in my opinion, would be to lower the cost of our energy again, namely by moving away from the green dogma and looking beyond very expensive American LNG.

While we in Europe are struggling with those challenges, the debt in the United States has completely gone off the rails, although their solution seems to be getting clearer: they are choosing inflation. That, too, will bring tensions.

In short, you'd think there are enough challenges to cool down the expensive markets a bit. However, in America, you could argue that prices are already pricing in the upcoming inflation.

But I'll repeat, I'm not going to time the market. If I come across heavily undervalued stocks, I'll buy them. However, I will be more critical about their cyclical nature, because we already have a lot of those. It's the ratio of price to value that will determine whether I step into the market or do the opposite. When the crash or a real correction arrives, that price-to-value ratio will automatically be better.