The Stock Market Has Changed

Weekly 22 2025 - market overview May

Saying the world has changed compared to ten years ago is stating the obvious. Compared to twenty, thirty, or fifty years ago, it’s even more true. The world is constantly evolving, and up until Covid, I’d even argue that most of those changes were improvements. Whether we’re still on that positive path remains to be seen. I’m optimistic, though there are signs pointing in the opposite direction.

The stock market, on the other hand, has been strikingly stable in its dynamics for about twenty years, at least since I became active in 1999. And judging by what I’ve read about the earlier periods, and that’s quite a lot, the market’s behavior wasn’t fundamentally different back then either.

Before diving into what exactly has changed, let’s first take a look at the current market, which reflects the shifts I’m talking about.

Market Overview – May 2025

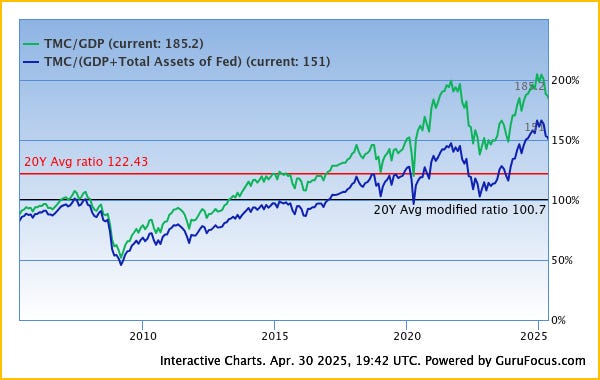

The drop in the ratio between total U.S. market capitalization and gross domestic product has now been nearly completely reversed. We haven’t reached the peak of November 2024 yet, but we’re back to where we were in September 2024.

The much-needed cooling off was once again very short-lived. This plays right into the hands of the passive investor, who assumes things will always bounce back and that the best time to buy more is during a dip. And because so many people followed this approach, the dip this time was, again, very brief.

For these investors, the valuation didn’t matter. All that matters is the price, not the actual earnings generated by the underlying companies.

Valuation No Longer Matters

The current price-to-earnings (P/E) ratio of the S&P 500 sits at 28, which translates to an earnings yield of 3.57%. In other words: if companies in the S&P 500 don’t grow their profits, you can expect a 3.57% annual return as an investor.

The Shiller P/E, which smooths out cyclical fluctuations, is even higher at 36.1. This suggests we’re currently in, or just coming out of, an economic boom, with earnings still running high. According to that method, the earnings yield is just 2.77%, again assuming profits remain stable.

So, the big question is: is that enough for risk capital? Because that’s what stocks are, risky investments. Especially when U.S. government bonds, supposedly the safest investment, currently yield 4.53% over ten years and even 5.03% over thirty.

The market is essentially telling us one of the following:

U.S. government bonds are less safe than S&P 500 companies;

We expect significant earnings growth;

We no longer care about valuations;

Or some combination of the above.

A large portion of profit growth in recent years came from the tech giants. Whether that trend can and will continue at the same scale is a big question mark for me. Add to that the slim chance of seeing another decade of falling interest rates and economic tailwinds, especially in today’s political climate of rising rates and inflation, and that second point seems shaky.

It’s possible that under Trump, trust in businesses has grown more than in the U.S. government. But I think it’s mostly the third point, valuation matters less and less, that’s driving things today, more than we realize.

The Market Runs on Emotion

The market has always been driven by two emotions: greed and fear. I’m convinced that this will continue in the long run. But when we zoom in on shorter periods, which can still span years, it’s clear the market has changed.

In the past, it was enough to buy stocks based on valuation. If something was cheap enough, it was just a matter of time before other investors noticed, started buying, and the price went back up to a fair level. When prices shot up too much, greed (and sometimes pure euphoria) took over, driving the stock above its intrinsic value, only for it to drop again, thus restarting the cycle.

Today, valuation alone isn’t enough. It remains the most important factor for long-term returns. I know many claim it’s all about ROIC, return on invested capital, but I don’t agree. As the famous baseball coach Yogi Berra once said: “In theory there is no difference between theory and practice. In practice, there is.”

Brief Tirade on ROIC

ROIC can only be the most decisive factor if you pick a top-tier company that can sustain outstanding performance for decades and if, as an investor, you’re lucky enough to hold onto it all that time without needing to cash out for a major purchase.

But sustainable competitive advantages (or “moats”) are hard to identify. The world changes so fast that a moat often disappears sooner than you think. And most of the time, you’ll only see that moat show up in the numbers years later, by then, you’ve already missed the biggest part of the growth.

Focusing solely on ROIC and “quality” without considering valuation is like driving using only the rearview mirror. It doesn’t help you make decisions today, especially when you don’t know what lies beyond the horizon.

I predict that within five to ten years, 90% of what’s currently labeled as “quality” will mostly turn out to be momentum stocks. And there’s nothing wrong with that, a momentum strategy can be very profitable. It often performs well when value strategies falter, and vice versa. Backtests even show that a combination of both can yield strong long-term results.

As long as you understand that you’re following a momentum strategy, nothing more.

End of tirade.

Buying purely based on valuation isn’t enough anymore. Fewer investors truly think for themselves, and those who do increasingly focus on growth, quality, and therefore momentum. The market is increasingly driven by algorithms, with passive investing being the simplest example: “I have money, so I buy.”

We’re seeing a shift from active funds to passive ones. In other words: we’re moving from investors who think critically about their choices (with mixed success) to investors who simply follow the trend. That’s precisely why momentum is performing so well right now.

Let’s be honest: a supermarket (Walmart), with a 2.5% profit margin and 5% growth, trading at a P/E of 41, is numerically indefensible.

With valuation no longer acting as a brake on rising prices, we rarely see stocks climb simply because they’re undervalued. There now has to be a catalyst that grabs the attention of the small group of investors who still think independently: a division sale, a merger, large-scale share buybacks, a management shake-up, a turning point in the cycle, and so on.

This shift in focus has led us to include more cyclical companies in our portfolio over the past six to twelve months, some of which have already been sold again (at a profit). Today, though, it’s harder to find companies that are not only cheap but also have a concrete trigger for movement. So I remain cautious and keep extra cash on hand from recent sales, ready to act when real bargains appear.

Articles and Updates This Week

On Tuesday, we published Lesson 14: The Power of Checklists, from our Introduction to Value Investing.

There was little relevant news from our companies this week, and I won’t bore you with filler content. I only highlight the important stuff.