Market overview april

Weekly 18 2025

As I write this first part, I'm sitting at Chicago O’Hare, waiting for my flight to Omaha. Over the next few days, I’ll be diving into a series of meetings and events with other investors. On Saturday, of course, there’s the Berkshire Hathaway meeting, where I’ll once again get to see Warren Buffett in action. Though these days, you no longer need to fly here for that, you can simply follow it online.

It feels fitting to write the market overview here too, especially since it often focuses on the U.S. stock market. Why this focus on the United States, when we specialize in European family businesses? Simple: when there’s a storm in the U.S., the winds usually reach Europe as well.

This time, however, things are different. While the S&P 500 has lost 6.2% since the start of the year, the DAX, for instance, has gained 13%.

It seems that some of the money that flowed into the U.S. last year is now staying in Europe. Even American investors appear to be looking for more diversification. That said, the shift isn’t widespread just yet: the French CAC 40 is up only 2.9% this year, the British FTSE 3.9%, and the Euronext 100—though I realize there’s some overlap with the French market, I don’t find the BEL20 or AEX individually very representative, has climbed 4.2%.

In my view, this movement isn’t driven by the underlying value of the companies, but mostly by ETF investors who are simply buying into the DAX.

Market Overview – April 2025

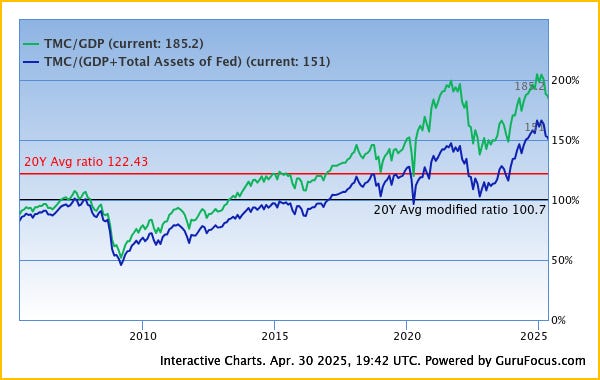

The decline in the U.S. was already visible last month in the Buffett Indicator, which compares total market capitalization to gross domestic product.

That cooling-off was definitely needed. But as you can see in the chart above, we’re still at a very high level, well above the 20-year average, which in itself isn’t low given the many strong years we've had.

The U.S. stock market remains particularly expensive. The expected return is just 1.2%, and that includes dividends. In theory, that return is compared to the yield on U.S. government bonds, which are considered risk-free. If stocks offer a lower return than these bonds, investing in equities doesn’t make sense—you’re supposed to get a risk premium, after all.

That said, I wouldn’t confidently claim that those bonds are less risky today than shares in solid companies.

Using the same approach, European stocks seem to offer more potential. Even Germany, the most expensive market in Europe, would still deliver an expected return of 1.3%. Sweden, Belgium, the UK, and Spain are among the cheapest, with expected returns ranging between 6% and 9%.

Of course, this is based on index level data. With thoughtful stock selection, returns can be higher.

I know I’ve been saying this for years, and yet our stocks continue to lag somewhat. We’re not losing, but we’re not gaining much either, except in the holdings. For now, I’m mostly relying on the returns the companies themselves generate, and I’m not counting on a revaluation of share prices.

I’ve come to accept that investors simply aren’t willing to pay as much per euro of profit for European stocks as they are for American ones. But if you buy something at a price-to-earnings ratio of 8, that gives you a return of 12.5%, and that’s before factoring in growth.

Articles and updates this week

Tuesday I posted Lesson 11 –Margin of Safety – from our Introduction to Value Investing.

In terms of earnings, we received reports from X-Fab and Focusrite: