Lesson 11: The Margin of Safety

Value investing 101

In previous lessons, we thoroughly discussed how to value companies and how to look for durable competitive advantages (moats). But even with the best analysis and the strongest companies, investing remains a world full of uncertainty.

That's why it’s essential to always work with a Margin of Safety: a safety buffer that protects you from mistakes, bad luck, and the unpredictability of markets.

What is the Margin of Safety?

Simply put, as Benjamin Graham wrote in The Intelligent Investor:

“Confronted with a like challenge to distill the secret of sound investment into three words, we venture the motto, margin of safety.”

The Margin of Safety means:

The difference between the intrinsic value of a stock and the price you pay for it.

The bigger the margin, the better you’re protected against mistakes in your analysis or unexpected events.

An example:

You calculate the intrinsic value of a stock at €100.

The market price is €70.

Your Margin of Safety is 30%.

Why is a Margin of Safety so important?

Most people believe markets are rational, that prices always reflect a company's true value. But that's simply not the case—and it’s easy to prove.

Just look at the big swings in the stock market. You don’t have to look further than 2008 and 2009, when stocks first fell by over 50% and then rose just as much or more.

A company's real value cannot drop by 50% and then double again within just two years.

What crashes and then rises is the stock price, showing that markets are not rational.

Another example: look at the 52-week high and low prices of companies. Often, they are more than 50% apart. A company does not become 50% more or less valuable within a single year.

The Margin of Safety matters because investing always involves risks and uncertainty.

As Warren Buffett puts it:

"When you build a bridge, you insist it can carry 30,000 pounds, but you only drive 10,000-pound trucks across it. The same principle works in investing."

In other words:

Don’t rely on perfection.

Build safety buffers so you can survive mistakes.

Even the best analysts make errors. Even the best companies run into trouble sometimes. The Margin of Safety is your parachute when things go wrong.

The Psychology Behind the Margin of Safety

You might think: But I do my homework, I analyze carefully, so why would I need a big safety margin?

Because the future is uncertain.

As Howard Marks writes in his book “The most important thing”:

"The margin of safety—the difference between the price you pay and the value you get—is the key to successful investing. It allows room for error, for bad luck, or for things to go wrong. It’s not enough to buy something for less than it’s worth; you have to buy it for much less. This gives you a cushion against loss in case your analysis is wrong or events don’t unfold as you expect.

The future is unknowable, and investing is primarily a matter of positioning capital to benefit from probable future developments. But those developments may not occur as expected, or even if they do, they may not have the anticipated effect on asset prices. The key is to ensure that your positions are robust enough to withstand a range of outcomes."

So even if:

The economy slows down,

Regulations change,

Technology disrupts your sector,

Management makes mistakes,

... a Margin of Safety ensures you don't lose everything.

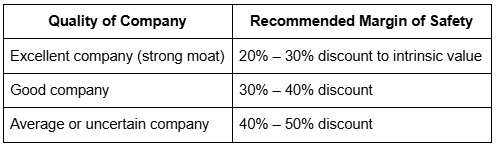

How big should your Margin of Safety be?

There’s no exact number, but general guidelines are:

In numbers:

Example 1: Without Margin of Safety

Intrinsic value = €100

You buy at €100

Stock crashes to €20 (an 80% drop)

To break even, the stock must rise by +400%!

Example 2: With Margin of Safety

Intrinsic value = €100

You buy at €60

Stock crashes to €20 (a 67% drop)

Now the stock needs to rise “only” +200% to get back to your purchase price.

The Margin of Safety limits your losses and increases your chances of recovery.

Common Mistakes About Margin of Safety

Using overly optimistic valuations

→ You calculate too high an intrinsic value and think you have a margin when you don't.Buying without enough margin

→ "It looks cheap..." but you’re actually paying close to fair value.Focusing on price drops, not value

→ A stock that's dropped by 50% isn't automatically safe. Always check the intrinsic value.Ignoring emotional pressure

→ Herd behavior (fear or greed) makes investors lose discipline.

As Seth Klarman warns in his book Margin of Safety:

"A margin of safety is achieved when securities are purchased at prices sufficiently below underlying value to allow for human error, bad luck, or extreme volatility in a complex, unpredictable, and rapidly changing world."

Margin of Safety ≠ Guaranteed Profit

It’s important to understand: A Margin of Safety reduces risk, but it doesn’t guarantee you will always make a profit

Investing will always involve chances and probabilities. But a good margin strongly increases your odds of success and softens the blow of bad luck.

As James Montier wrote:

"Valuation is as close as you get to the law of gravity in finance. It’s the primary determinant of long-term returns. But the goal of investing is not to buy at fair value—it’s to buy with a margin of safety. This reflects the reality that any fair value estimate is just that: an estimate, not a precise figure. The margin of safety provides a critical buffer against error and misfortune."

Value Investing 101: beginner friendly course

In the current market situation, I believe it's time to create an introductory series on value investing—a method that focuses on buying businesses at a price lower than their true value.