Focus on the companies, ignore the noise

Weekly 15 2024

Last month’s weekly update was titled: “Volatility is not the same as risk.” I opened with a quote from Marc Faber’s Gloom, Boom & Doom Report:

“The whole world is crazy. Stocks will fall 30%, then rise 20%, and then fall again by 30%. That’s going to be the pattern. If you can’t live with that, stay out of stocks.”

Even Faber couldn’t have imagined that one man could cause such extreme swings in just a few days.

Today, I can hardly come up with anything better than what I wrote back then to stress that these price movements have nothing to do with the underlying companies or their performance.

The first ideas I put on paper Tuesday were already outdated by Wednesday afternoon. And what I wrote down Wednesday afternoon was irrelevant by the evening.

So, I’ll keep it simple: focus on the companies, ignore the rest.

Still, there are a few striking points worth sharing. The first one aims to show that we need to play the long-term game—where company performance drives stock prices—because the short-term game is rigged.

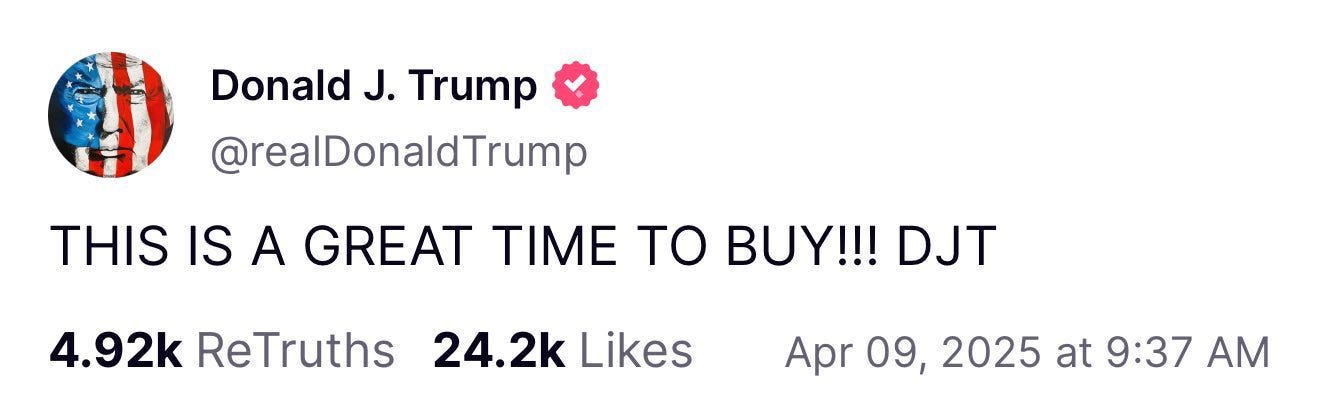

A few hours before announcing a 90-day pause on tariffs, the President of the United States posted this on his own social media platform, Truth Social:

Now combine that with this message:

Someone made millions with insider information. This is the market we’re operating in today. The big question is: Who was it, and do they have a direct link to Trump? Will we ever find out?

That there’s foul play involved is crystal clear.

All bluff

Can Trump actually push through the extreme tariffs he’s proposed, especially the new ones on China, over the long term?

Sure, this cartoon is over the top, and we shouldn't underestimate the weight of the U.S. in global trade, they’re still the world’s biggest consumers. But some things just don’t work in practice.

To illustrate, I’ll shamelessly borrow a passage from a recent memo by Howard Marks:

But let’s assume the first three goals listed above are actually achieved, causing more of the goods purchased in the U.S. to be made in the U.S.:

First, in most cases, there isn’t sufficient manufacturing capacity that can be switched on. For example, I doubt there’s a factory in the U.S. capable of producing flat screens for TVs or computers. It would take years to build enough capacity to satisfy a meaningful percentage of U.S. demand, meaning in the interim there would be shortages and/or selling prices would likely be at the old levels plus the tariffs.

Second, the new factories designed to bring back manufacturing jobs would take years to permit and build, and the cost of construction would have to be justified by an expectation of profits many years out in the future. This adds further complexity to decisions that had already been made challenging by uncertainty regarding future developments in automation and AI. Are CEOs likely to commit to those investments based on tariffs that might be subject to renegotiation (or discontinuation when a new administration takes office)? Bear in mind that Trump’s 25% tariff on Mexican and Canadian goods replaced the United States-Mexico-Canada Agreement he negotiated during his first term and that went into effect in 2020, which in turn replaced NAFTA, which was enacted in 1994.

Third, there probably aren’t enough skilled workers available in the U.S. to take the place of all those in China and the developing world who presently make goods for us.

Fourth, why have Americans been buying imports in the first place? Because they’re cheaper. Why did the U.S. lose the jobs it lost? Because American workers were paid more than workers elsewhere for the same job, but U.S. products weren’t good enough to justify higher selling prices. That’s why the U.S. went from importing 330 Volkswagens in 1950 to more than 400,000 in 2012. It wasn’t that U.S. tariffs were too low. The simple truth is that foreign goods often cost less than comparable goods made in the U.S. Even if tariffs are set high enough in the future to render U.S.-made goods cheaper than imports-cum-tariffs, the prices will be higher in the absolute than Americans are used to paying. This morning, for example, it was mentioned on TV that a smartphone made in the U.S. might cost $3,500.

Since most Americans have little income left over after paying for necessities, the result of higher prices is likely to be declining standards of living. That’s true unless wages rise as fast as prices, but in that unlikely case we’re talking about a dangerous inflationary spiral.

In short: America can’t sustain these import tariffs long-term without seriously hurting itself.

ETF investors still in charge

Another takeaway from this week, especially from Apple’s 10% jump yesterday, is that most of the money in the market is still driven by emotion, not analysis. And most of it flows through ETFs.

Trump said he wants a 10% tariff on most countries, but for China it would be 125%. That the market reacts euphorically to a 10% tariff is already madness, since that’s higher than what most countries charge on U.S. goods. But let’s focus on Apple for a moment.

Apple doesn’t manufacture its iPhones in the U.S. As Howard Marks mentioned, a U.S.-made iPhone would cost around $3,500, four times the current price. Most iPhones are still made in China, with some production in Brazil and India.

So the 125% tariff is clearly bad news for Apple. Yet the stock still rose 10% yesterday along with the broader market. Why? Because ETF investors drove the price, not investors looking at the actual data. Otherwise, Apple would’ve dropped.

This week

Fortunately, it was a quiet week on the company news front. That gave me time to calmly revisit all our holdings, reflect, and draw conclusions for the future.

The panic some investors felt when the market dropped 5% three days in a row is totally foreign to me. Of course, it’s unpleasant to see your portfolio value go down, but I know what I own. And I’m confident that these companies can weather a storm in global trade, or even a recession, and likely come out stronger.

That’s exactly why I’m drawn to value investing. It keeps your emotions in check by focusing on the companies themselves. It also allows you to act while others panic, because you know the intrinsic value and take the long view.

I postponed this week’s new lesson in our Intro to Value Investing course so I could fully focus on reassessing our portfolio and preparing for targeted actions. I mentioned that in Monday’s brief message, where I urged calm.

You’ll find those conclusions below, along with the top five stocks to buy for April.