Everyone wants to buy cheaper

Market and portfolio overview august + new transactions

On Monday, August 5, it seemed like the market was hitting a turning point. Panic set in and stock indices dropped. However, by Friday of the same week, it appeared that everything was already forgotten, and the mood had returned to one of optimism and cheerfulness.

Our portfolio also experienced a decline on that day. Although it's not unusual for the portfolio to fluctuate, I noticed that the decline (relative to the invested capital) was significant, especially given that it involves cheap stocks. The fact that the recovery seemed slower also suggests that the market has not yet changed. The market hasn’t shifted to small caps and value stocks. So, August 5th does not appear to have been a turning point.

In this article

The market today

Doubler Portfolio overview

New transactions Doubling Portfolio

Current top five stocks

The market today

Last month, I had my doubts about the reports indicating a shift from large tech stocks to small caps and value stocks. After the events of August 5, we can conclude that the largest stocks are still the most important, as well as index investing. Those who claim otherwise on forums and X often risk being vilified.

It remains a challenge to invest rationally with "common sense," rather than being swayed by flashy numbers on the screens. Patience is being tested.

My biggest concern is not whether this situation will ever change—history shows it always does, and as long as fear and greed exist, it will change again. My greatest concern is that a whole generation of investors now believes that the returns of the past ten or even fifteen years are the norm. The exceptional returns achieved with index investing are likely to revert to the mean, which means we may face a few lean years ahead. I hope they continue with their periodic saving and don't start making irrational decisions.

While many argue that you should keep dancing as long as the party lasts, I prefer to look at the situation rationally.

Rationally speaking, the U.S. stock market is still very expensive. On the 20-year chart, you can't even see the decline from early August. Even when measured over one year, it continues to deviate significantly from the gross domestic product (GDP).

The Shiller PE ratio also increased from 35.2 last month to 36.2 now. This brings us close to the peak of the past 20 years, which was 38.6, and far from the low point of 13.3.

Given that stock markets can fluctuate between these values and the average, including all the good years, is 26.6, the historical average is 17,5. I keep wondering how much room there still is for this to stretch before it snaps.

However, the market remains very peculiar and bifurcated. It’s no problem finding good, solid companies that you can pick up cheaply. For some, cyclicality plays a huge role, and investor fear drives prices down too much, as was the case with the company proposed yesterday.

As expected, the picture has changed somewhat after reviewing the half-yearly reports. While larger companies provided decent results and mainly focused on warnings for the second half of the year, we are now seeing that smaller companies are indeed experiencing delays.

This was already clearer in Europe and has been further confirmed. Smaller companies are often the first to feel the impact of delays.

Overall, the numbers still hold up well, or perhaps I am just a pessimist seeing things worse than they are. Of course, that’s not true, as stock investors need to be optimistic, but I always try to be cautious in my valuations, preferring to present scenarios on the conservative side. I don’t want to count myself rich.

The conclusion remains the same as in recent months: we continue to see extreme valuations in certain segments of the market and cheap stocks in others. While I don’t see a general overvaluation of the market, the Buffett Indicator suggests that caution is still warranted.

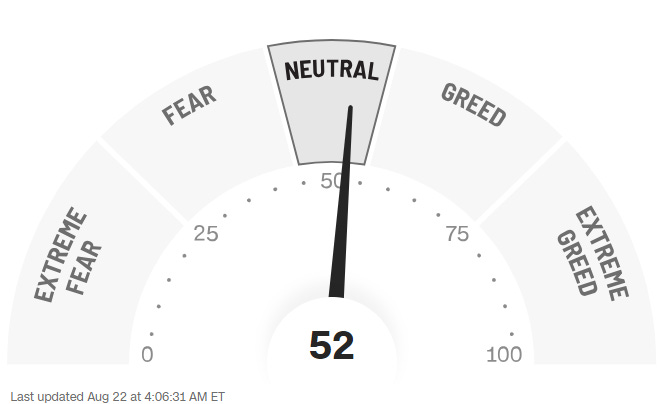

The Fear & Greed Indicator (CNN) remains neutral, but whereas it leaned slightly towards fear in July, it is now moving back towards greed.

It’s very subjective, but I still perceive a sense of greed on X (Twitter) and investment forums. However, as August showed, this sentiment can shift very quickly.

Last month, I concluded the market overview with the observation that the media had prematurely declared the rotation from large-cap (big tech) stocks to small-caps and that the shift seemed to be happening mainly at the index level. For now, this seems to be confirmed. The rotation will undoubtedly happen; it's just the timing that’s unpredictable.

In any case, we are in a prime position to benefit from it once it occurs. Meanwhile, I’ll continue to search for and pick up interesting companies.

Doubler Portfolio overview

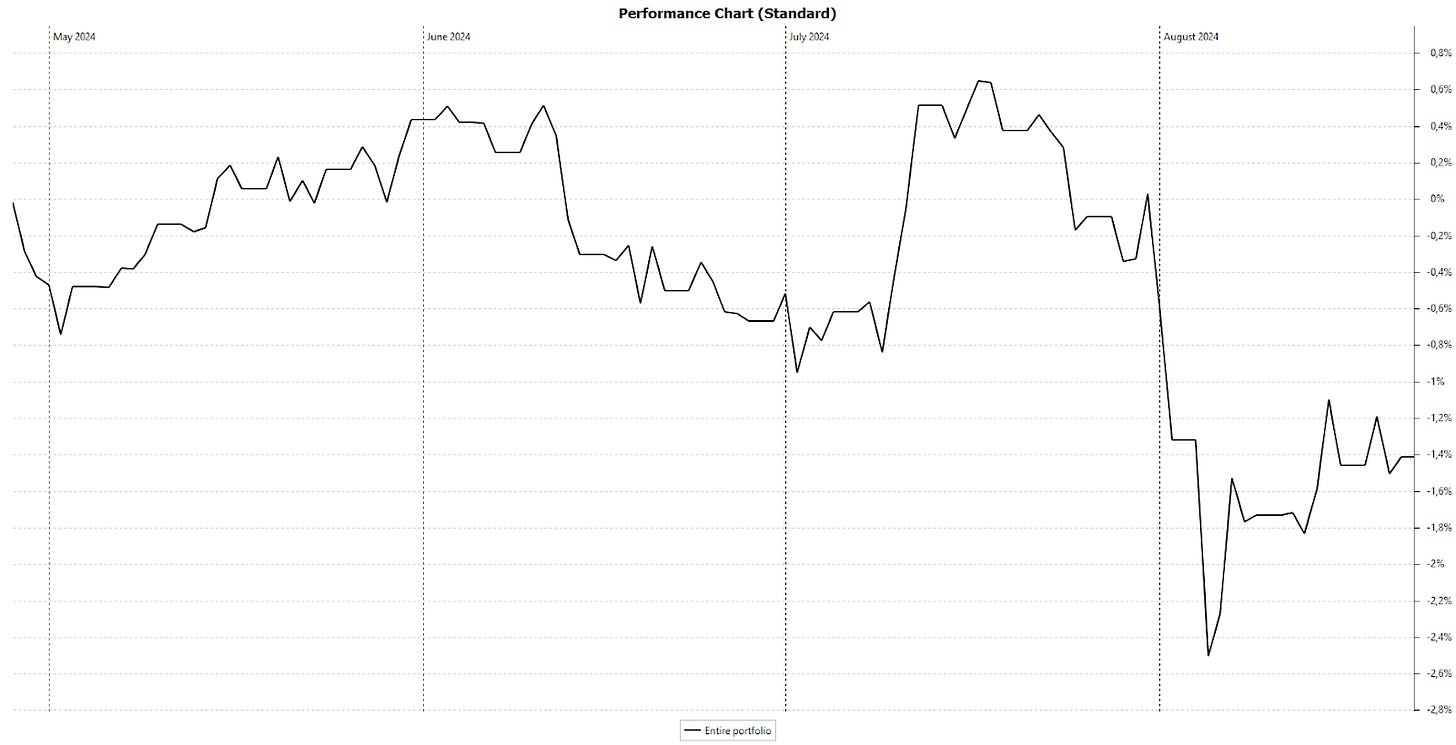

In our portfolio, which is only 37% invested, the decline from early August is quite evident. Of course, not as pronounced since nearly 63% is still in cash, but enough to be noticeable when you open the portfolio.

The fact that our smaller and particularly cheaper stocks did not recover to the same extent highlights that the markets are still focused on that narrow group of stocks and indices. For us, this is a good thing, as it allows us to continue investing at lower prices.

Especially our two automotive-related stocks took a hit, and our companies in the construction sector remain very cheap.

At Tessenderlo, the share buyback helped stabilize the stock price after the weak earnings report, which will be discussed in our weekly update tomorrow.

Perhaps this share buyback could be the catalyst for an adjustment in the stock price. Previously, the book value with data providers like S&P and Reuters was listed at €22 per share, an incorrect calculation due to the own shares listed in the books of a subsidiary. As of today, however, the book value is correctly listed at €31.04.

This gives us the following overview.