Bonava: Numbers are hiding improvements

H1 2025

Short description

Bonava is a Swedish homebuilder that focuses on constructing homes for both investors and individuals. The company builds houses, villas, apartment buildings, and even entire neighborhoods. It operates in Germany, Sweden, Finland, Estonia, Latvia, and Lithuania.

The company specializes in spreading risks by building different types of homes and targeting different markets. Investors often pay a portion of the price upfront, while individuals only pay upon occupancy of the house. Although sales to individuals generate higher margins, the risk is spread through customer diversification.

Bonava was spun off from the conglomerate NCC in 2016. NCC constructs offices, large apartment buildings, hospitals, warehouses, and infrastructure.

Bonava operates in 19 regions across the mentioned 6 countries, with Germany being the largest market, accounting for 55% of the revenue, primarily around Berlin, Cologne, Bonn, and Saxony. Bonava still sees Germany as a growth market.

Why we selected Bonava

When I originally wrote about this company in the Dutch newsletter, it was trading at one-third of its tangible book value. My assertion from the beginning was that even though the stock was only trading at one-third of book value, I anticipated a doubling. This was because I expected there to be write-downs and a capital increase that would erode book value.

The capital increase is behind us, and we’re noticing a turning point in the housing market. Germany is the powerhouse, but how are things going in Sweden in the meantime?

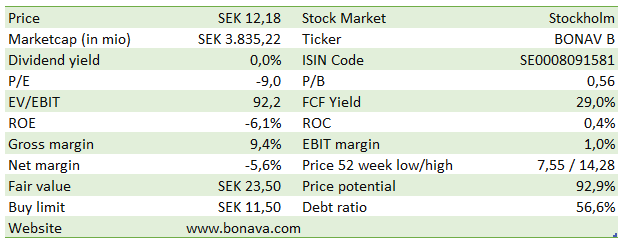

Updated ratios

Just like last year, Bonava has once again posted a loss in the first half of the year. This is no longer due to restructurings or capital reductions, but because a sale is only recorded once everything is finalized, while the costs are incurred earlier.

If we look only at the most recent quarter, we see a return to profit. The ratios are still not very useful, but compared to the previous quarter, we’re already seeing improvements across the board.

This remains an investment made purely on the basis of significant undervaluation—it's not a company we intend to hold on to forever.